Krones Group Annual Report 2021

“Krones is emerging from the coronavirus crisis even stronger than before. We are making good progress in continuously improving Krones’ competitiveness and future readiness.”, Christoph Klenk, CEO

Strategy and management system

Krones has come through the Covid-19 pandemic comparatively well so far. The company quickly adapted its strategy to the new realities. However, this does not mean at all that Krones is returning to business as usual. Our markets, and the increasingly volatile global economy, present us almost every day with new challenges, and also new opportunities.

One real challenge relates to the difficult situation on procurement markets. Viewed globally, the Covid-19 pandemic is also far from being over. On the other hand, our markets present opportunities with regard to digitalisation and sustainability.

To ensure the most successful possible future for Krones, the company will master two key challenges. First, in order to secure its future, Krones must have the best possible organisational and cost structure. This is not a once-only change, but an ongoing process that demands great energy and discipline from the whole workforce. Second, we will make use of future growth opportunities in our attractive market to shape a successful future for our company. Innovations are an important part of this.

Improving cost structure is an ongoing task

The cost-reduction measures launched in past years are taking effect. Among other things, the workforce reduction decided in 2019 and 2020 was completed in the reporting year. This necessary capacity adjustment will be reflected in the full-year figures for the first time in 2022. In addition, we will continue to simplify structures and processes throughout the Group and to optimise production costs. We still see further scope for savings in project execution, adapting the product portfolio and optimising the degree of value added in-house. By systematically implementing these changes, Krones will make costs more flexible and be able to respond better to future fluctuations in demand.

A further important focus is expanding our global value chain. This allows us to better use regional resources and makes us less vulnerable to protectionist trade restrictions. We are also gaining significant cost advantages by establishing regional production sites and supply chains in Hungary and China. Producing at our Debrecen site in Hungary will save us around €20 million per year

by 2024.

Digitalisation and sustainability established as new megatrends

One lesson learned from the coronavirus crisis is that Krones’ markets show stable growth over the medium and long term. They soon recover from temporary setbacks, as in 2020. This is due to long-term megatrends: global population growth continues, the middle class in emerging economies will keep on growing and urbanisation will continue.

Issues around digitalisation and sustainability have gained massively in importance among our customers in recent years. They have become established as new megatrends and will additionally drive the medium and long-term growth of the filling and packaging market.

Pandemic an added boost to digitalisation

Digitalisation was already an important focus for Krones and our customers long before the Covid-19 pandemic. However, travel restrictions during the pandemic made the benefits of digitalisation even more obvious, especially in services and when bringing newly installed machinery into operation. This is why the digitalisation of beverage plants is no longer just a vision, but is already delivering significant added value for plant operators today.

We are only at the early stages of digitalisation in the beverage and packaging industry. But that makes it all the more important for Krones, with the Krones.world platform, to take a leading position in this area as elsewhere. In Krones.world, we have brought together all digital products services on a single platform. This lets customers access all digital Krones products that are relevant to them with a single login across different devices.

Line expertise the basis for new business models

Filling and packaging lines are made up of many individual machines and systems. Krones has profound expertise regarding interoperation between the individual components. This line expertise also provides the foundation for exploiting the opportunities of digitalisation and for developing new business models.

Krones aims no longer to be solely the maker of machines, equipment and spare parts, but to service and manage customers’ entire lines on the basis of service agreements. This allows Krones to generate more revenue from recurring business. Other positive effects of the digital service model are that the business has lower volatility and greater scalability.

Krones supports customers in their carbon footprint and sustainability

Reducing carbon emissions and resource consumption is high on the agenda for almost all Krones customers. They also expect their suppliers to contribute in this regard – including Krones. This is why we launched our TÜV-certified enviro sustainability program as long ago as 2008. The resulting improvements in the energy efficiency of our products have already led to significant resource savings for our customers over many years.

Krones will further extend its role with regard to sustainability. To this end, it has set the goal of ensuring that Krones machines and lines reduce resource consumption for customers by a further 25% between 2020 and 2030. Krones aims to reduce its own carbon emissions even more significantly – by 80% – during the same period.

Krones focuses in the core segment on all three major container types: PET, glass and cans

Sales of the various packaging materials vary with consumer trends. Interest in PET bottles has increased again since the coronavirus crisis, for example, after a fall in demand for PET in 2019 due to the plastics debate – most of all in Western Europe. Since the pandemic, more drinks are consumed at home and less in bars and restaurants. That has significantly boosted purchases of canned beer and carbonated beverages. We will further extend our strong market position in can lines. But glass, too, remains the second most widely used packaging material after PET, is versatile and refillable, and continues to be highly popular among consumers.

To absorb fluctuation between the three major packaging materials – PET, glass and cans – Krones provides complete filling and packaging lines for all three. Krones will also continue to invest in the development of innovative products for all three types of packaging in order to maintain its technological edge.

Sensitive products add to growth in process technology

In the Beverage Production/Process Technology segment, Krones focuses not only on beer and soft drinks, but also on sensitive products such as milk and juices. Producing and storing these products requires the highest standards of product safety and product quality. Krones is further expanding the product range in this high-end sector.

An additional, increasing focus in this segment is on the production of alternative proteins. These will contribute significantly to climate change mitigation. Alternative proteins substantially reduce carbon emissions relative to the consumption of conventional meat. With its process technology solutions, Krones intends to play an important role in this still young but rapidly growing field.

Intralogistics making above-average contribution to growth and is a separate segment from 2022

Intralogistics subsidiary System Logistics has become an important pillar in the Krones portfolio. It already generated almost half of segment revenue in the Process Technology/Beverage Production segment in the reporting years and is expected to continue growing at an above-average rate in the coming years. Krones reports Intralogistics as a separate, third segment from 2022 due to its size and for added transparency.

System Logistics benefits from strong market growth in logistics and e-commerce. In addition, Krones plans to further expand its intralogistics operations in the Asia-Pacific region and in India. Efforts to develop the US market will be stepped up through our established sites in the USA and Mexico.

To achieve its growth targets in the USA and further improve profitability, -Krones will expand capacity in software and project management and shorten project lead times.

Recycling PET to cut plastic waste

As well as addressing climate change, Krones also helps combat another urgent problem facing humanity: reducing plastic waste. Here, the company is working on a resource-efficient material cycle for PET. This ranges from material-saving packaging design and low-energy container production to the recycling of used plastics. This centres on high-quality recycling of returned PET bottles in order to reuse the material in production.

With its various Metapure lines, Krones has already provided high-end recycling solutions for true bottle-to-bottle recycling for many years. Many major customers will significantly increase the proportion of recycled PET (rPET) in their bottles – in some cases by 50% or more – by 2025. Krones has all major core technologies needed to produce new PET bottles from used PET bottles in what is called bottle-to-bottle recycling.

Although rPET is chemically identical to virgin PET, there are differences in processing. Krones supports customers in refitting their production lines for the circular economy. All new Krones PET filling lines are already able to process up to 100% rPET with the same quality and efficiency.

Due to the rising demand, PET recycling will become increasingly important for Krones in the years ahead. By 2023, some 20% of plastic bottles produced on newly sold Krones lines could be recycled by Krones recycling systems. In the reporting year, this figure stood at around 10%. The long-term target is to get as close as possible to 100%.

Krones one-stop-shop solution for PET recycling lines

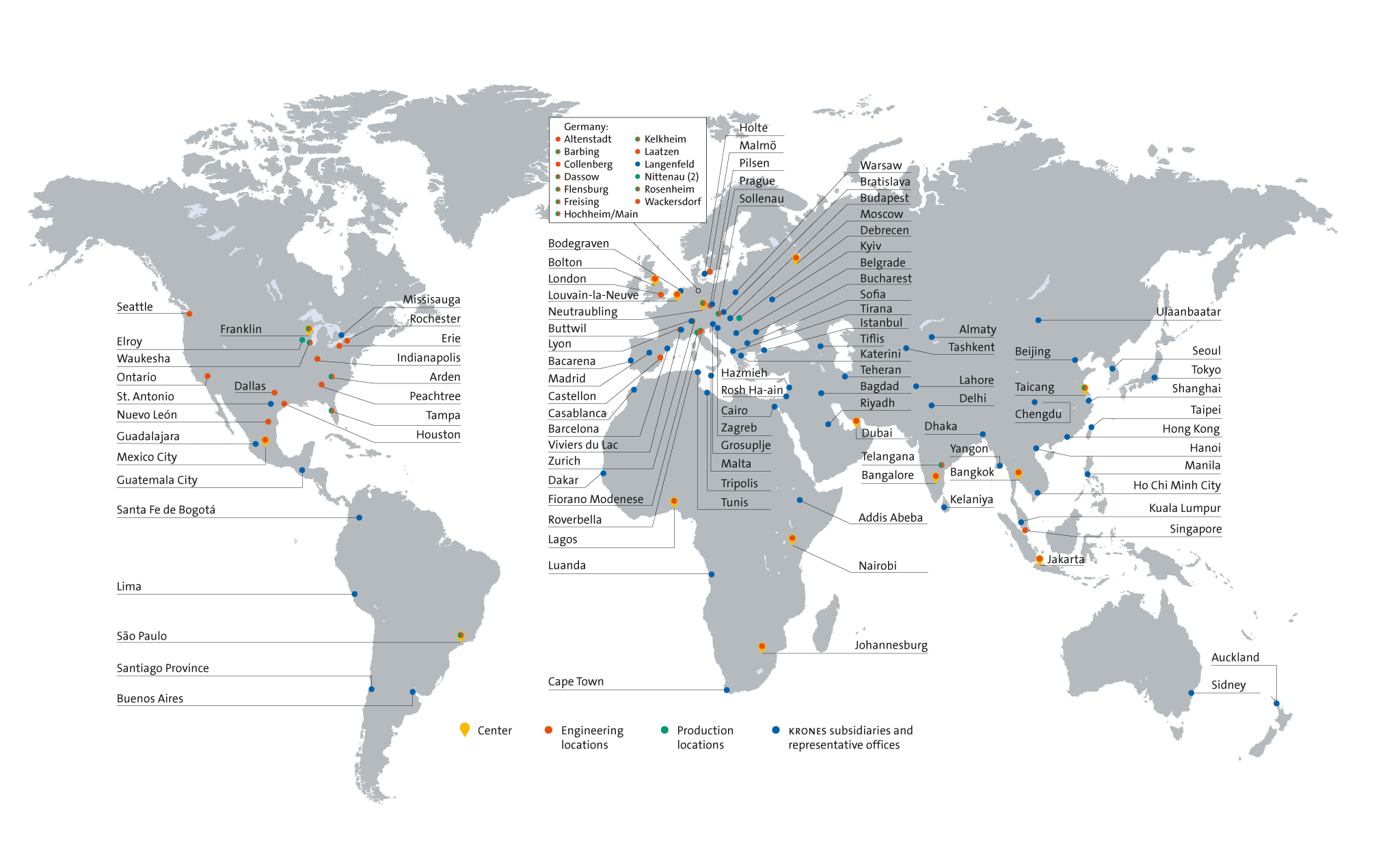

Growth through further internationalisation

Krones has long sold most machines and lines internationally and some 40% of the workforce are now employed in locations outside of Germany. Further -internationalisation nevertheless remains a significant growth driver in both segments. The Covid-19 pandemic and the resulting travel restrictions have highlighted the benefits of Krones’ global footprint. Long before that, however, growing protectionism in various parts of the world already provided sufficient reason to develop global production, sales and service locations.

The focus is on the emerging markets, and primarily the Asia-Pacific and Africa regions. These will develop well above average, mainly because of the rapidly growing middle class. Krones will expand its existing operations in these regions. This will make the Krones service network more tightly meshed than ever, and closer than ever to our customers. And that enables us to address customers’ needs quickly and directly. The company once again increased the size of its emerging markets workforce during the reporting period following a slight decline in 2020 due to the coronavirus crisis.

Higher selling prices to offset rising material costs

The significant demand growth in the reporting year meant that selling prices recovered from the low level of the 2020 pandemic year. Krones was also able to push through the price rises announced in August 2021. This largely offset the higher purchase prices for materials. Despite continued intensive competition, Krones sees itself in a good position to pass on rising material and labour costs to customers.

Innovation secures the company’s future growth

Attractive and innovative products and services are a fundamental requirement for lasting improvements in price quality. They provide clear and measurable added value. The greater the benefit for customers, the more willing they are to accept higher prices. Sustainability and digitalisation especially hold major potential for adding value. We showcase a small selection of our innovations from the reporting period on pages 62 to 70.

Strong focus on free cash flow

Alongside growth and profitability, the ability to generate cash from the day-to-day business is a further key criterion for the long-term success of any business enterprise. Krones therefore places a strong focus on free cash flow. The company generated a free cash flow of €203.3 million in the reporting period. Krones’ goal for the coming years is to increase free cash flow in step with higher profits and with improvements in return on capital employed (ROCE).

Krones Global Footprint

A key factor influencing the development of free cash flow is working capital. In 2021, the working capital to revenue ratio stood at 24.8%, which is inside our target corridor of 26–27%. Less working capital tied up in the operating business means more capital for other purposes. Working capital also affects ROCE, as it is part of capital employed. As working capital goes down, ROCE goes up – on the same EBIT.

Optimising working capital therefore remains a core task. Although working capital will always be subject to fluctuations, the company has already taken various steps to reduce working capital in all key areas that influence it – trade receivables, inventories, trade payables and advance payments.

Stable financial and capital structure provides scope for investment

The positive free cash flow performance in the reporting period further strengthened our good capital base. At the end of 2021, Krones had some €378 million in net cash and a very solid 39.8% equity ratio. In addition, the company has around €1 billion in undrawn credit lines. A very solid financial and capital structure is important in today’s crisis-prone global economy. It gives us sufficient scope for investment in growth and the future.

Most of that investment will be made within the business. To develop innovative products, Krones will continue to spend some 5% of revenue on research and development. In the years ahead, capital expenditure on property, plant and equipment will settle in a band between 2.5% and 3% of revenue. This will mainly be spent on expanding our international locations and IT systems.

In light of its financial strength, however, the company is also increasingly considering acquisitions. Here, Krones looks for mid-sized companies that strengthen its existing portfolio technologically and regionally, or that expand the range of products and services in filling and packaging. Acquisitions outside of the beverage industry are also a possibility.

In addition, we will continue to allow the company’s owners to share commensurately in our success in the form of dividend distributions. Krones’ dividend strategy is to pay out 25% to 30% of consolidated net income to shareholders, -although in past years it has aimed for the upper end of this range.

A company is only ever as good as its employees

The sadly-needed reduction in the workforce was completed in the reporting period. This measure was undeniably difficult for our workforce. However, it did nothing to change Krones’ corporate culture of team spirit and pulling together. We and the entire team are now focused optimistically again on the future. That means responding flexibly to the challenges ahead and making targeted use of market opportunities. To this end, Krones will selectively strengthen its workforce in the coming years, primarily in the areas of IT and software, and also in the emerging markets.

Our motivated and qualified employees secure the company’s future. They are the face of the company and it is they who ensure that customers are satisfied with Krones products and services. For this reason, Krones will continue to commit above-average investment to training and employee development.

New medium-term targets adopted by Krones to 2025

The company maintained its medium-term financial targets even during the coronavirus crisis:

- 2% to 5% average organic revenue growth per year

- 9% to 12% EBITDA margin (corresponding to an EBT margin of 6% to 8%)

- 24% to 26% working capital to revenue ratio

As reported at this point last year, Krones aimed to achieve these targets by 2023. After the 2021 financial year went significantly better than originally expected, it is now possible that the lower range of the previous medium-term targets will be achieved not in 2023, but already in the current 2022 financial year. However, this depends on the overall economic situation.

Krones has adopted new ambitious medium-term targets to 2025

Revenue is expected to increase from €3.6 billion in 2021 to around €5 billion by 2025. On an organic basis – meaning without acquisitions – the company aims to grow revenue by an average of 5% per year (previously 2–5%), to €4.5 billion. The remainder is to be achieved by further growth outside of the beverage industry and also by means of acquisitions.

Krones plans to continue growing profitably in future years. To this end, it targets an EBITDA margin of 10–13% in the medium term (previously: 9–12%).

Krones is introducing return on capital employed (ROCE) from 2022 as a new target for the efficient use of capital. This replaces the previous third target, working capital as a percentage of revenue. ROCE reflects both working capital and fixed assets. In addition, ROCE gives investors an even more accurate picture of how efficiently the company manages the capital it uses. Krones has -already published ROCE as a key performance indicator in past years. Its target for ROCE is a significant increase to at least 20% by 2025 (2021: 10.0%).

Krones’ management primarily uses the following financial performance indicators to steer the group and its two segments:

- Revenue growth

- EBITDA margin (earnings before interest, taxes, depreciation and amortisation as a percentage of revenue)

- Working capital as a percentage of revenue (until 2021)

- ROCE – return on capital employed (from 2022) – the ratio of EBIT to average net capital employed in the past four quarters. Net capital employed is defined as non-current assets (excluding goodwill and financial assets) plus working capital.

In order to strengthen our market position and utilise economies of scale, we aim in the medium-term to achieve revenue growth above the market average.

Earnings before interest, taxes, depreciation and amortisation (EBITDA) is a key earnings performance indicator. Profitability, measured as the EBITDA margin (EBITDA as a percentage of revenue) is among our key targets and parameters. The EBITDA margin indicates the company’s profitability in relation to revenue, irrespective of the tax rate, financial income/expense and depreciation and amortisation. For the group, we set the target margin as the weighted average of the two segments.

Our third major performance indicator is working capital to revenue, which is calculated at group level. Working capital is calculated as follows: (inventories + trade receivables + contract assets) – (trade payables + contract liabilities).

This figure indicates how much working capital is needed to finance revenue generation. The lower the number, the less capital is tied up in operations and the more financial leeway the company has to use its cash resources for other purposes.

Changes from the 2022 financial year onwards

From the 2022 financial year, we are replacing the working capital to revenue ratio with ROCE (return on capital employed). The reason for the change in the third target is that ROCE reflects both working capital and fixed assets. ROCE shows investors how efficiently the company makes use of capital. The other two performance indicators (revenue growth and the EBITDA margin) remain unchanged.

In addition, commencing in the 2022 financial year, Krones now manages the group via three segments. The Intralogistics segment is added alongside the two existing segments. This is because the Intralogistics business, which was previously part of the Beverage Production/Process Technology segment, has attained a commensurate size as a result of the previous years’ strong growth. The new segmentation also enhances the transparency and depth of Krones’ segment reporting.

Other financial key performance figures

In addition to the above, a further important performance indicator for Krones is free cash flow (cash flow from operating activities less cash flow from investing activities). We take further guidance from the development of EBT (earnings before taxes) and the working capital to revenue ratio.