The 2019 financial year has clearly shown the need for changes at Krones. So that the company stays competitive going forward, the Executive Board has decided structural measures that are now being implemented. Among other things, we are further expanding our global footprint and optimising the entire House of Krones product portfolio. We will eliminate the weaknesses in the company overall.

Despite the many challenges, we look to the future with confidence and self-assurance – because Krones’ strengths clearly predominate. We are outstandingly well positioned in markets with stable growth in the medium and long term. Our workforce is both highly qualified and highly motivated. Moreover, the company has very sound finances and a stable majority shareholder. Building on this strong foundation, we are sure that together with our team, we have Krones set on success.

These are the measures to keep Krones on track for success.

By the end of 2020, Krones will implement a total of 600,000 production hours at its new locations in Hungary and China.

The new Hungarian production facility is expected to save Krones about €5–10 million in 2020. When it is fully established, we expect annual cost savings of €20 million. The production facility in China will deliver savings of at least €2 million in the first stage.

Added to this are 200,000 construction hours in Hungary, China, the Czech Republic and India.

The plant in Debrecen, Hungary, will be fully operational by the end of 2020. It will then have a capacity of 36,000 working hours per month. At the beginning of 2020, the new plant had 450 employees. Another 50 are to be added by the end of 2020.

Krones has already significantly expanded its emerging markets workforce in past years. At the end of 2019, we had 4,187 employees in emerging markets, 33% more than in 2018.

That has a simple reason: To take advantage of market growth opportunities in emerging economies, we need more employees in the regions where customers are located. We already employ about 24% of the workforce in emerging markets. Given corresponding market growth, we will further increase that percentage.

A critical success factor in process technology is the ability to support customers locally with capabilities along the entire value chain. For this purpose, Krones has built up and expanded in-house capacity in recent years. We have additionally strengthened our process technology capabilities with acquisitions.

In this way, Krones has gained process technology locations in the USA and China. These will generate positive earnings contributions from 2020.

To increase profitability for the long term, group processes and resources are to be further optimised and organisational units streamlined.

As part of its efficiency measures, Krones has already reduced full-time jobs in Germany in 2019. This will continue in 2020.

In Germany, the structural measures result in the loss of 500 jobs, comprising 200 in the reporting period and 300 in 2020. About 200 jobs will be cut internationally by the end of 2020.

The measures to reduce personnel costs necessitated around €30 million in provisions in 2019 and had a corresponding negative impact on earnings. By reducing the workforce, Krones expects savings in personnel costs totalling around €45 million in 2020 and 2021.

Process technology is one pillar of the House of Krones. It includes products and areas that are developing well. Overall, however, profitability in process technology is insufficient. This is mainly due to beverage production. We are going to make this a legally independent unit.

This enables us to better assess how the individual businesses, specifically with regard to the different types of beverages, are developing on a standalone basis.

After several acquisitions in the past, we currently plan no acquisitions in process technology.

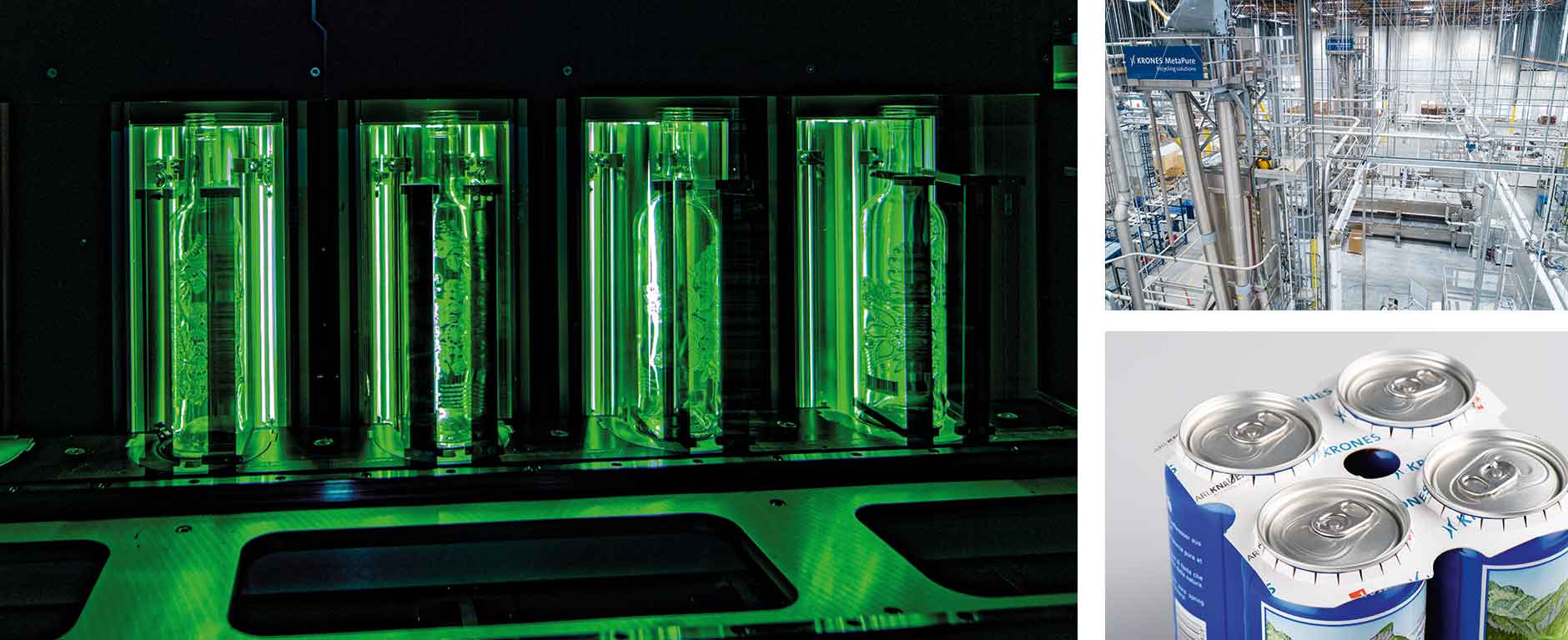

This segment is suffering as a result of the critically skewed debate about plastics. We create sustainable material cycles with our high-quality PET recycling systems, material-saving container design and low-energy container production.

At the same time, we continue to expand our product portfolio in glass and cans as packaging types.

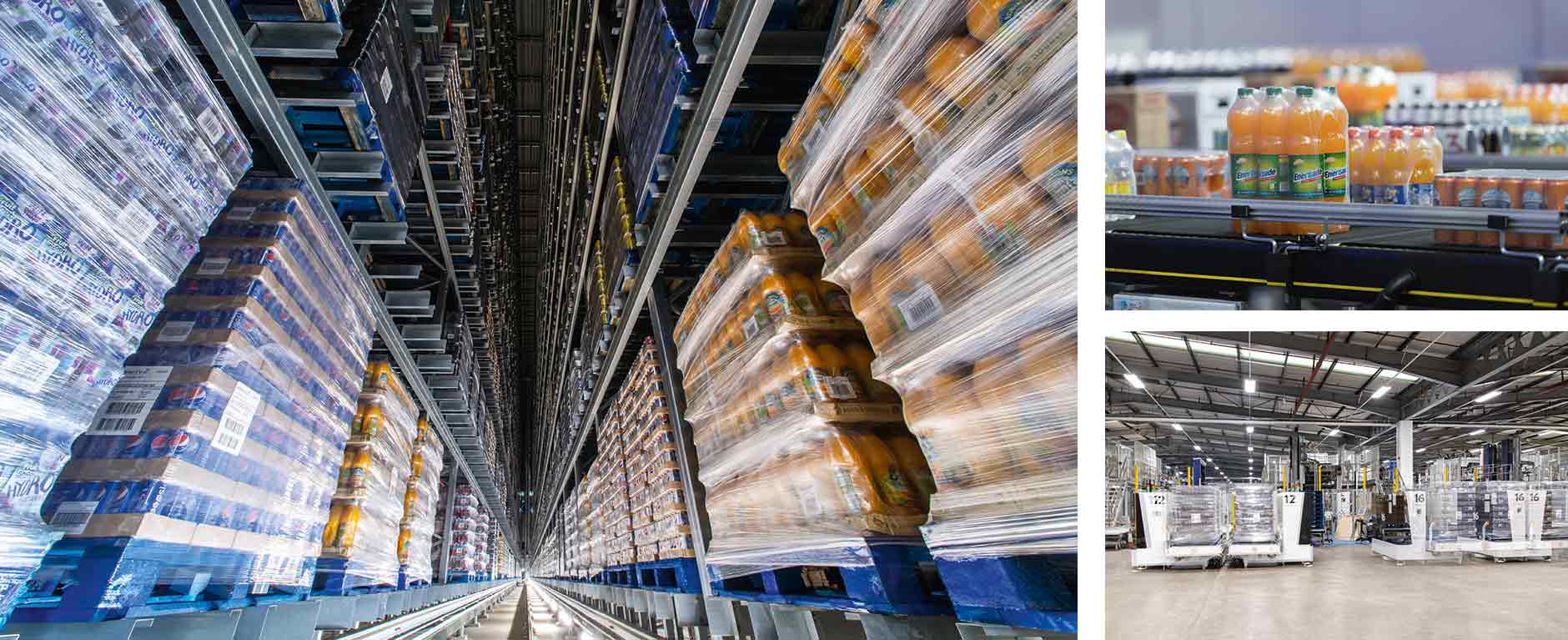

The third pillar of the House of Krones, intralogistics, continues to see very good demand for our products and services. We will manage the rapid rate of growth and push ahead with internationalisation.

For this purpose, we have pooled all intralogistics activities in System Logistics and made this a legally independent unit.

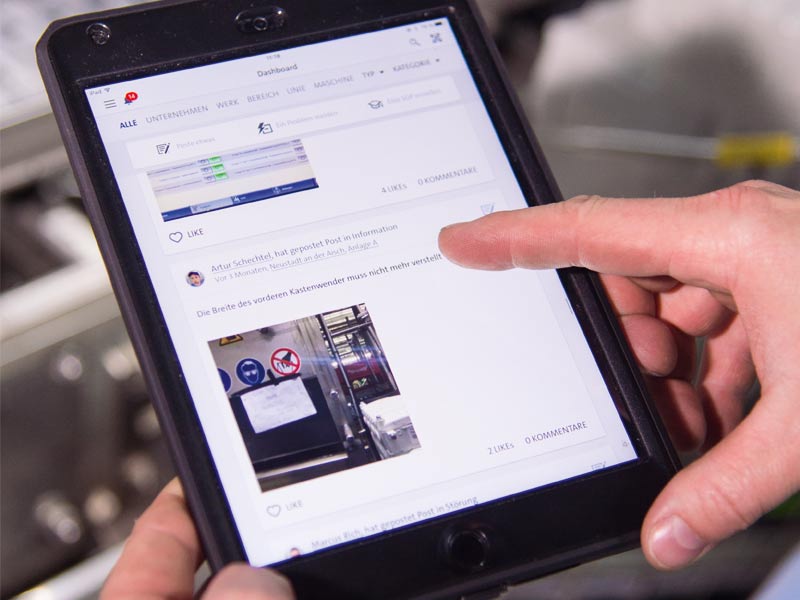

Looking ahead, we will concentrate our digitalisation activities more intensively around solutions for our core bottling and packaging equipment segment and notably for lifecycle services. Overall, investment in digitalisation will continue to impact profitability in the next few years.

Krones sees good market opportunities here in the medium to long term.

At about €2 billion, cost of materials is by far the largest expense item in the statement of profit and loss.

Expansion of our global footprint relates not only to production, but also to the procurement of material inputs. Best-cost country (BCC) sourcing secures us significant reductions in procurement costs.

We will rigorously continue with the international procurement measures we have implemented so far.

Krones has already successfully implemented this in Taicang, China. It has also established a supplier network in India, Taiwan, Thailand and Turkey.

BCC procurement volume totalled around €45 million in 2019. This will continue to rise and will deliver significant cost savings in the years ahead.

Large potential savings in procurement

Price increases are necessary in order to partially offset rising labour and material costs. The basis for this is strong price discipline. Realistically, a €10–20 million earnings contribution is attainable.

A 1% price increase on self-produced machinery would provide an additional EBT contribution of €10–15 million in 2020.

Due to the strong installed base, the after-sales market has considerable growth potential for Krones in the medium to long term. Krones has around 40,000 machines installed in customers’ factories. Further expanding our service locations around the world will enable us to significantly increase our service business. Our LCS team so far serve about 60% of our installed base.

Each percentage point generates €12 million annually in profitable service revenue.