Equity Story

Strong market position

As the market leader, Krones is in an excellent position to benefit from industry growth

Krones operates worldwide, delivering leading technologies for filling and packaging, process engineering, and intralogistics as well as solutions for digitalization for the food and beverage industries.

In the largest segment by far »Filling and Packaging Technology« Krones offers machines and lines with which customers fill, label, pack and transport their products, primarily in PET bottles, glass bottles and cans. The lines provided by the segment additionally include machines and systems for producing PET bottles (using injection moulding and stretch blow moulding). Also in this segment, Krones offers recycling systems for converting used plastic bottles into food-grade recycled material (PET recycling). A further important part of the segment is the service business.

Krones is the global market leader in its core business of filling and packaging technology. In addition to the two big European competitors KHS (a subsidiary of the Salzgitter Group) and the french Tetra Laval subsidiary Sidel, there are a number of smaller competitors.

In the segment »Process Technology« Krones supplies customers with machines and lines for producing and processing softdrinks, fruit juices, milk, dairy drinks, beer and alternative proteins. In addition to water treatment, the Process Technology segment also includes components (valves and pumps) under the Evoguard and Ampco Pumps brands, together with the service business.

In the segment »Intralogistics«, through subsidiary System Logistics, Krones provides the planning and design of fully automated warehousing, order-picking and material flow systems with automated guided vehicle (AGV) systems together with matching software tools. Software and other services are an additional part of the segment.

Business model

Krones is well positioned in the competitive arena as a full-service, full-range provider with a broad international footprint. We supply all machines and lines needed for producing, filling and packaging beverages. Furthermore, we provide complete logistics systems and custom IT and digitalization solutions that manage and optimise all production processes.

Services are an important part of Krones’ business model. Krones has service centres and offices around the world. Our around 3,000 service technicians in more than 70 countries support customers worldwide around the clock with spare parts and high-quality services.

Stable growth

Krones benefits from megatrends

Krones operates in long-term growth markets. The positive development is driven by megatrends. Global demand for packaged beverages continues to increase, fuelled by a rising global population, an expanding middle class and urbanisation. As demand for packaged beverages increases, so does the need for innovative filling and packaging technology and for process technology and intralogistics solutions.

Sustainability is another megatrend that benefits Krones. Our customers need resource-efficient machines and lines to reduce their carbon footprint, meet their climate targets and lower costs.

Megatrends

City dwellers consume more packaged products on average than people who live in the countryside. Increasing urbanisation – the migration of people from rural areas to cities – consequently drives demand for packaged food and beverages.

According to the United Nations (UN), over half of the world’s population lived in cities in 2020. By 2050, the urban share of the population is expected to grow to two-thirds. The strongest influx of people into cities is in the developing and emerging economies of Africa and Asia.

More and more people are escaping poverty and rising into the middle class, especially in Asia. According to a study by the Brookings Institution, a US think tank, 3.5 billion people worldwide belonged to the middle class in 2020. This figure is expected to grow to a total of 4.8 billion by 2030. As incomes rise, so too does consumption – and that includes packaged beverages and foods. According to the Brookings Institution, global consumer spending by the middle class will increase from US$44 trillion in 2020 to US$62 trillion by 2030.

The one overarching megatrend is global population growth. At the end of 2024, some 8.2 billion people inhabited the earth. The United Nations (UN) estimates that the population will go on growing for decades to come. According to the UN, the world’s population will reach 8.5 billion by 2030, an increase of around 300 million on the end of 2024. All these people need to eat and drink.

Sustainability is very important to our customers. They want to save resources and reduce their carbon footprint. With the enviro sustainability program, Krones has been focusing on the eco-efficiency of its products and services for many years. We are thus also playing a pioneering role in the growing area of sustainability.

Growth regions

We are located where beverage consumption is growing strongly

Thanks to its broad global footprint, Krones is well positioned in the regions where consumption of packaged beverages is expected to grow at an above-average rate in the coming years. The strongest growth in demand is likely to be in the region Asia/Pazific. According to GlobalData figures, consumption there is expected to increase by an average of 4.5% per year from 2024 to 2027. In China (+3.3% p.a.) and the sales regions of Africa/Middle East (+2.9% p.a.) demand for packaged beverages is also expected to increase at an above-average rate during this period.

Revenue by region

Balanced revenue worldwide

Krones is represented in all regions of the world and occupies a strong market position. The company is in a position to even out fluctuations in individual regions. On the whole Krones has a well-balanced distribution of sales. In 2024, the company generated around half of its consolidated turnover on the emerging market and about half in mature industrial countries.

Profitability

Krones intends to increase profitability

Krones' profitability has been impacted by high material and personnel costs in recent years. In 2020, the Corona crisis and restructuring expenses weighed on earnings. Krones has adjusted its capacities and laid the foundation for increasing profitability with further structural measures. The EBITDA margin has improved significantly since 2021. In order to consistently develop the Group further and be able to finance growth - without significant use of debt - Krones' goal is to further increase profitability. In addition, profitable operations create scope for investments and dividends.

Expanding our global footprint

In order to improve profitability, Krones will strengthen its global presence. In the future, more procurement, engineering, and parts of production will take place in the regions in which our customers operate their plants. That will enable us to deliver regionally-adapted products to the emerging markets at competitive prices.

Strong services business

Being close to customers is critical

The practical implementation of services is the job of our approximately 3,000 local service technicians in over 70 countries around the world. With their factory and line expertise, they respond quickly and directly to customer needs – a key factor in long-term customer satisfaction.

- Over 6,000 service staff worldwide

- 3,000 service technicians

- 1,200 production and supply chain experts

- 1,800 technical support and back office staff

- On-demand global spare parts supply

- Digitalisation for next-level service

Large installed base as the foundation for stable service revenue

Krones has a broad installed base of beverage and packaging machinery worldwide. To ensure that these systems remain productive over their entire service lives, we offer our customers a wide range of services as well as replacement parts and upgrades. Overall, this ensures stable growth in sales with Lifecycle Services (LCS). The attractive LCS business is thus benefiting from the growing installed machine and line base. In addition, Krones will further increase the proportion of its own lines serviced.

Long-term value creation

Krones distributes 25% to 30% of its consolidated result to its shareholders

Krones takes care to ensure that the capital provided to the company by its shareholders earns a decent return. One key figure that provides information on this is the return on capital employed (ROCE). It puts earnings before interest and taxes in relation to the average net capital employed. The company allows shareholders to participate appropriately in the company's success through dividends. Krones generally distributes 25% to 30% of consolidated net income as dividends.

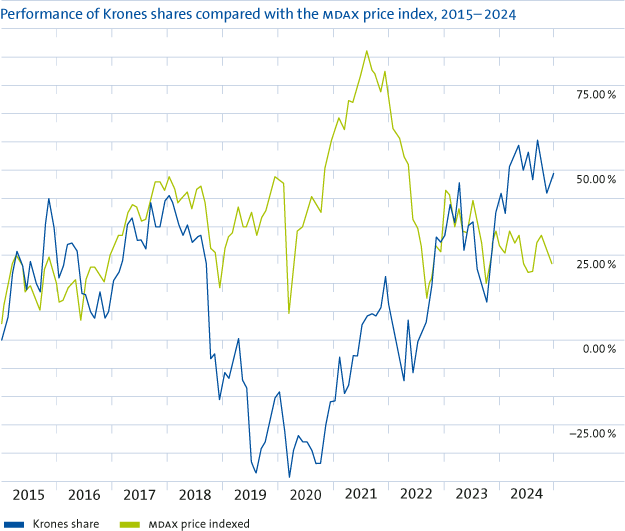

The Krones share in a ten-year review

The past ten years from 2015 to 2024 have seen our share price increase by 49%. Krones’ average annual share price gain over the ten-year period comes to 4.0%. The MDAX Price Index – the MDAX excluding dividends – gained an average of 2.0% per year over the same period. Krones shares are thus a clear outperformer over the long term. This also applies when dividends are included. Including paid-out dividends, and assuming these were reinvested in Krones shares after payout, the average annual return on our shares since 2015 comes to 5.6%. The comparable MDAX performance index rose by an average of 4.2% per year over the last ten years.