The world has changed dramatically due to the Covid-19 pandemic. Not only did the many lockdowns cause a massive slump in the economy. The pandemic has also significantly changed ordering patterns among business customers and purchasing patterns among end consumers.

Krones, too, is affected by this ‘post-corona’ world and will consequently adapt its strategy to the new circumstances in the years to come. To achieve this, the company must manage two key tasks. First of all, Krones must master the currently still difficult economic situation to the best possible effect. This will secure our future. In parallel, we will think ahead to be prepared for the forthcoming recovery in our markets. With innovations and investments in growth, we are laying the basis for a successful future.

One of the most important findings of our autumn 2020 customer survey conducted by the Executive Board was this: After a phase of holding back on investment, the food and beverage industry will return to growth. In the medium and long term, many megatrends point to sustained growth in the filling and packaging market. Global population growth will persist, the middle class in emerging economies will keep on growing and urbanisation will continue.

Cost-cutting measures are working – and have to continue

But first of all, suitable measures are needed to mitigate the corona-related drop in demand. Customers clearly indicated that their investment will not yet regain 2019 levels in 2021 and 2022. We are therefore adjusting capacity to the lower business volume in the short and medium term.

The reduction in the workforce decided on in autumn 2020 is just one of many necessary measures. On the positive side, the cost-cutting measures outlined here last year are taking effect. We will continue to implement these. They include simplifying structures and processes, optimising production costs, reducing material costs and adjustments to our product portfolio. During the reporting period, we made good progress with the spin-off of the brewery activities (Steinecker) and will now take various measures in the current year to improve profitability in this business.

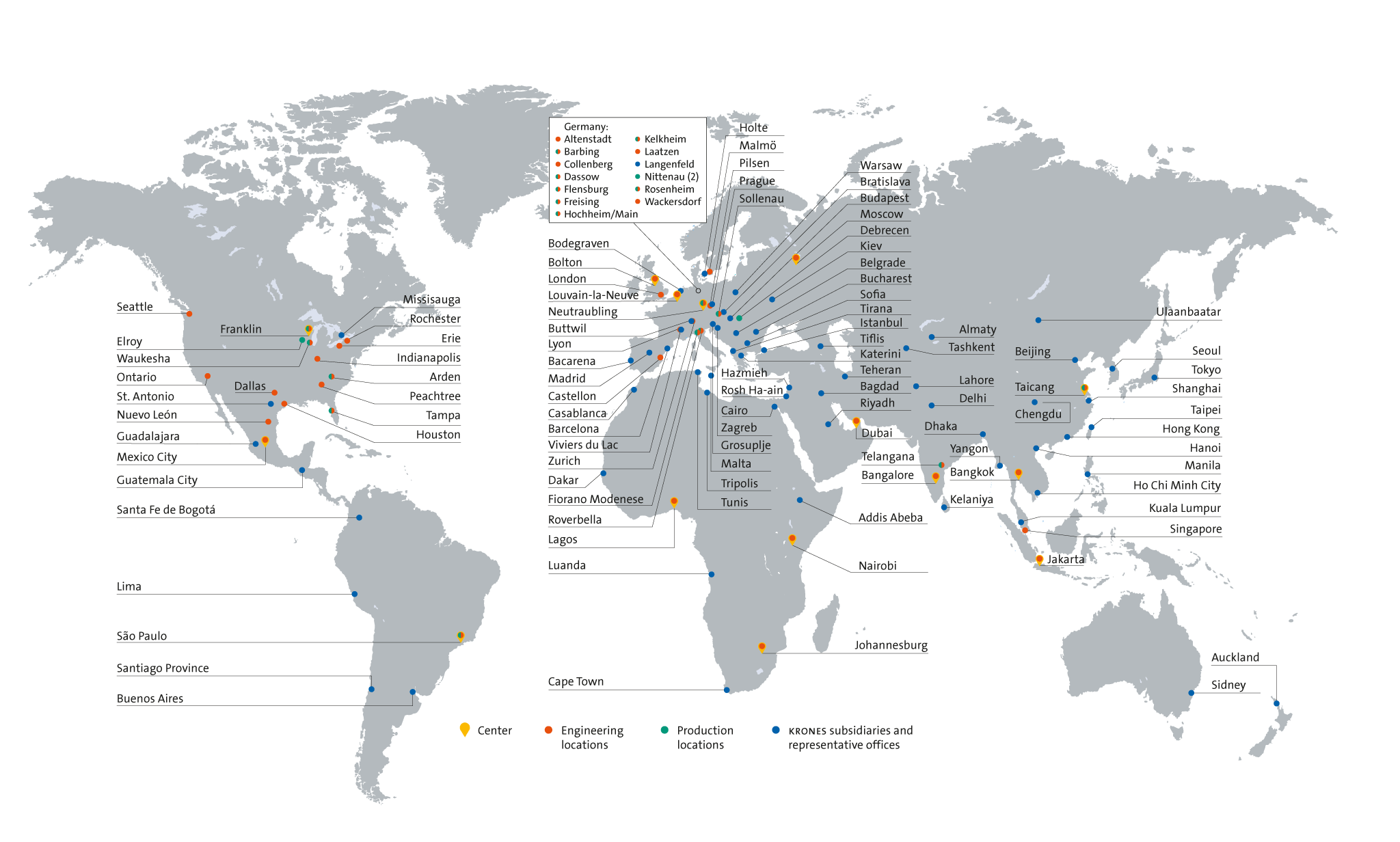

We also continue to place strong focus on expanding our global value chain. This allows us to make better use of regional resources and makes us less vulnerable to protectionist trade restrictions.

Krones Global Footprint

With a few months’ delay due to corona, production started in 2020 at our new site in Debrecen, Hungary. The plant will be fully operational by mid-2021 – provided that the further course of the corona pandemic allows – and will lead to cost savings this year. From 2022, the annual cost savings will be around €20 million.

To better manage demand fluctuations in the medium term, the company will adjust the degree of value added in-house. This enables Krones to make its costs more flexible, and to focus internal resources on its core competencies.

All of these measures serve to secure Krones’ international competitiveness. The cost savings are necessary so that we have sufficient latitude for future investment and further growth.

Post-Covid era offers opportunities for growth – clear focus on core competencies

The global economic impact and changes caused by the coronavirus are enormous. But the worst is presumably behind us, and life and the economy will ‘normalise’ again after the pandemic.

Many experts expect our market to recover strongly till 2025. It will benefit from the ongoing, intact megatrends in emerging markets, and also from massive stimulus programmes in industrialised economies. In order to make the best possible use of the opportunities in our market following the corona pandemic, we will focus in future even more strongly on our core competencies of sales, engineering, final assembly, life cycle service and digitalization. We also plan to use these core competencies to open up new markets.

Digitalisation to accelerate

Krones sees major opportunities above all in the field of digitalization, where it employs over 300 software engineers and IT specialists. The focus in all digital innovations is on adding value to our products. Customers increasingly expect our machines and lines to reduce their operating and labour costs. The digitalization of the beverage plant plays a key role here. This means making our filling and packaging lines smarter. In this way, we can further enhance system availability and increase automation. Predictive maintenance and rapid troubleshooting are a further element. Our aim is to provide customers with digital tools and services on a single platform that enables integrated control of the entire line from process technology to instrumentation and control systems, including all production data, and all the way through to software solutions. To achieve this goal, we will continue to increase investment in the digitalization of our machines and lines.

Intralogistics a key part of the Krones portfolio

One important pillar in the Krones portfolio is intralogistics. This will accelerate digitalization in beverage plants by ensuring an optimum flow of materials and data. Intralogistics itself will also benefit from market changes highlighted by Covid-19. These include faster delivery, greater automation and increased online ordering. With System Logistics, Krones is ideally equipped to meet changing customer requirements. We will expand intralogistics – which is delivering above-average growth – as a strategically important pillar in the House of Krones, and further improve profitability.

Sustainable PET solutions are major growth drivers

Another key finding from the customer survey was that the beverage industry wants to actively address the plastic waste problem. A core component of this is the recycling of plastics, and most of all PET. Going beyond official targets – in the EU, recycled PET (rPET) is to account for at least 25% of the market by 2025 – many customers have adopted even more ambitious targets of their own. In some cases they aim for a 50% rPET share by 2025. Krones expects that by 2030, on average, rPET will account for 50% of PET packaging worldwide. That creates opportunities that we will make use of.

With its various Metapure lines, Krones has already provided high-quality -recycling solutions for true bottle-to-bottle recycling for many years. Krones plans to expand this still relatively small business within the group in the years ahead, in order to tap into the rising demand for recycling lines. This will not produce a significant jump in revenue over the short to medium term, however, because of the long project lead times.

Although rPET is chemically identical to virgin PET, there are differences in processing. Krones possesses comprehensive expertise in all facets of manufacturing and processing rPET containers. It will support customers in refitting their production lines for the circular economy of the future. In addition, by 2025, all new Krones PET filling lines will be able to process up to 100% rPET.

CO2 reduction a clear goal of Krones customers

A further important concern for our customers alongside resource-conserving PET recycling is reducing CO2. Krones has set itself the ambitious target for the ecoefficiency of the machines and lines it produces to reduce the carbon footprint in the upstream and downstream value chain at the customer (Scope 3 emissions) by 25% from 2019 to 2030. We are ideally placed to achieve this goal. As long ago as 2008, Krones launched the enviro sustainability programme with the focus on conserving resources and increasing the energy efficiency of our machines and lines. Krones was ahead of its time with enviro and is now in a very good position. In addition, we have set ourselves the target of an 80% reduction in our own (Scope 1 and 2) CO2 emissions by 2030.

Internationalisation increases customer satisfaction and reduces risks

The travel restrictions during the corona pandemic show the importance of local presence for Krones in the world’s regions. Growing trade conflicts, too, underpin our efforts to expand our global production, sales and above all service network. The rapidly growing African and Asian markets are particularly important here. Krones will continue to expand its workforce and local presence in these emerging markets. The closer Krones is to customers with its team, the faster it can meet their requirements and increase customer satisfaction.

Selling prices to recover in the medium term

The corona crisis and the resulting weakness in demand put pressure on selling prices in the reporting period. Krones focused on maintaining a good balance between capacity utilisation and price quality. This year, the company expects prices to remain stable compared to 2020 due to a projected slight increase in demand. In subsequent years, more rapid market growth should be reflected in rising prices.

Innovation secures the company’s future growth

For the long term, price quality will also be supported by innovations. These must provide customers with clear and measurable added value in terms of costs, versatility, environmental compatibility, and product and production safety and reliability. An example is equipment that enhances the sustainability of packaging. The greater the benefit for customers, the more willing they will be to accept higher prices. Digitalisation especially harbours major potential for adding value.

The workforce is the decisive factor in the company’s success

The decision to cut several hundred jobs was not easy for either the Executive Board or the Supervisory Board. Most of all because of the many years and decades of outstanding work delivered by our employees. We nevertheless had to adjust workforce capacity so as not to put the future of the company at risk. These measures in no way diminish our appreciation of the workforce. The Executive Board knows the huge importance of the employees for the company’s success. It is they who ensure that customers are satisfied with Krones products and services.

Looking to the future, we continue to need motivated and dedicated employees. Krones will continue to invest above-average in training and employee development. These remain the basis for our future expertise and Krones’ long-term viability.

Stable financial and capital structure

In a crisis, it is of paramount importance to have sufficient liquidity. Krones continued to do so throughout the difficult 2020 financial year. The company maintained liquidity reserves of around €1 billion for almost the entire year. This meant that the group retained its capacity for action at all times and had enough reserves to survive a prolonged downturn. At the end of 2020, Krones even had a net cash position of some €185 million. Combined with a very solid equity ratio of 39.4%, this adds up to a stable financial and capital structure. This gives the company sufficient financial headroom both to invest in growth and the future and to accord shareholders their due share of the company’s success in the form of dividends. Krones’ dividend strategy is to pay out 25% to 30% of consolidated net income to shareholders.

Strong focus on working capital and free cash flow

Krones generated a positive free cash flow of €221.3 million in the reporting period. That is a good outcome considering the difficult year in 2020. Going forward, we will further improve free cash flow in order to strengthen our capital base and internal financing capability.

The most important parameter here is lower working capital. In 2020, average working capital over the past four quarters as a percentage of revenue stood at 28.3% which is some way from our medium-term target of 24% to 26%. Less capital tied up in the operating business means more capital for other purposes. For each percentage point by which we lower this ratio, our free cash flow and therefore our available resources grow by around €35 million.

The main burden on working capital is the high level of customer receivables. Among measures to reduce these, Krones will shorten the timespan from delivery to invoicing. To this end, on-site assembly and acceptance are to be completed sooner. Using a variety of other measures, it is planned for trade -receivables to grow below average in the next few years relative to revenue. Centralising inventory management and the supplier financing programme launched in the final quarter of 2020 will have further positive impacts on working capital.

Capital expenditure to settle at a lower level

A further important factor in free cash flow is capital expenditure on property, plant and equipment. Krones invested heavily in expanding its global footprint in 2018 (3.2% of revenue) and 2019 (2.7%). For the reporting period, this figure was a very low 1.7% of revenue. In the years ahead, capital expenditure will settle in a band between 2% and 3% of revenue. No acquisitions are currently planned. However, we always retain the capability to act on attractive acquisition opportunities should they arise.

Medium-term targets to be attained by 2023

Despite the corona crisis, Krones has not lost sight of its ambitious medium-term financial targets and continues to adhere to them. In order to exploit the opportunities available in our market and to maintain sufficient headroom for investment, we aim to deliver the following:

- 2% to 5% average organic revenue growth per year

- 9% to 12% EBITDA margin (corresponding to an EBT margin of 6% to 8%)

- 24% to 26% working capital to revenue ratio

Krones has made a slight upward adjustment to the third target. Previously, the target for the working capital to revenue ratio was 22% to 24%.

The timeframe for target attainment has been pushed back by the Covid-19 pandemic. Provided there are no new economic, health or political crises, Krones aims to attain the targets by 2023.

Krones’ management system

Krones ’ management primarily uses the following financial performance indicators to steer the group and its two segments:

- Revenue growth

- EBITDA margin (earnings before interest, taxes, depreciation and amortisation as a percentage of revenue)

- Working capital as a percentage of revenue

In order to strengthen our market position and utilise economies of scale, we aim in the medium-term to achieve further revenue growth.

Earnings before interest, taxes, depreciation and amortisation (EBITDA) is a key earnings performance indicator. Profitability, measured as the EBITDA margin (EBITDA as a percentage of revenue) is among our key targets and parameters. The EBITDA margin indicates the company’s profitability in relation to revenue, irrespective of the tax rate, financial income/expense and depreciation and amortisation. For the group, we set the target margin as the weighted average of the two segments.

Our third major performance indicator is working capital to revenue, which is calculated at group level. Working capital is calculated as follows: (inventories + trade receivables + contract assets) – (trade payables + contract liabilities). This figure indicates how much working capital is needed to finance revenue generation. The lower the number, the less capital is tied up in operations and the more financial leeway the company has to use its cash resources for other purposes.

Other financial key performance figures

In addition to the above, a further important performance indicator for Krones is free cash flow (cash flow from operating activities less cash flow from investing activities). We take further guidance from the development of EBT (earnings before taxes) and ROCE (return on capital employed, the ratio of EBIT to average capital employed).