Krones’ markets show relatively stable growth. Long-term, growth rates are expected to be above global GDP growth. Besides our big competitors, a number of smaller providers also contend for -orders. However, most of these competitors offer products relating to subsegments of beverage production, filling and packaging, or are only focused on specific regions.

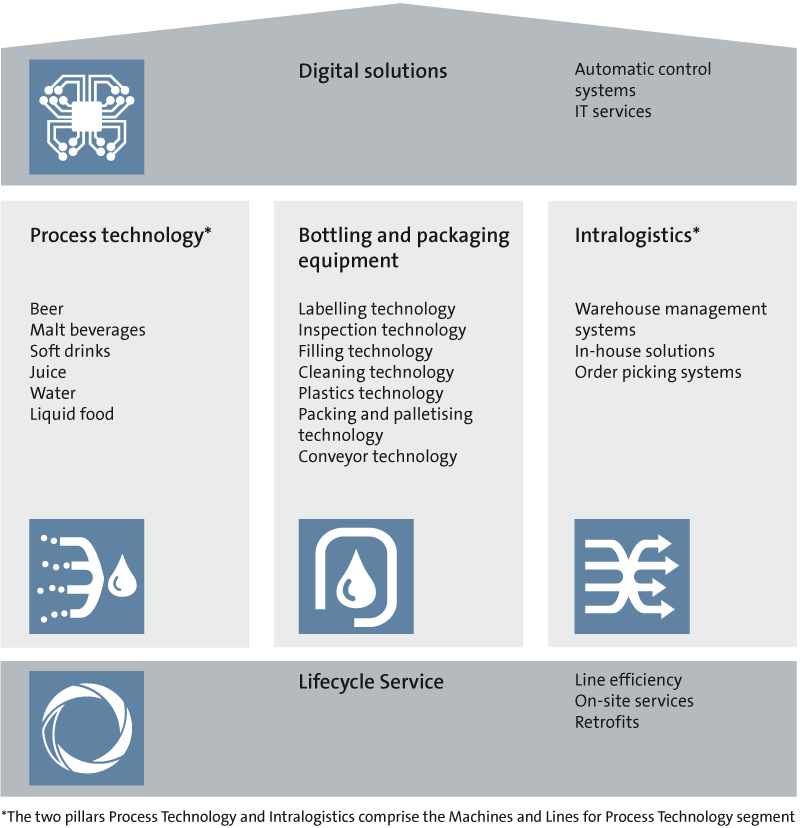

Krones is very well positioned with its full global portfolio of products and services. We provide customers from the liquid food industry with everything they need from a single source, from beverage production to filling to packaging. Intralogistics solutions, information technology and high-level after-sales service complete the portfolio. Krones aims to defend its strong market position in the core bottling and packaging equipment segment and to significantly improve its position in process technology/beverage production.

Just as the market harbours opportunities, Krones also faces major challenges. Political uncertainties, trade conflicts and economic crises in individual countries and regions create for unpredictability. Competition for orders will remain intense, as competitive pressures are not easing. On the customers’ side, mergers and acquisitions result in enhanced buying power and sometimes delay investment.

The ongoing digitalisation and integration of production are also increasingly changing our market and business models and requires investments.

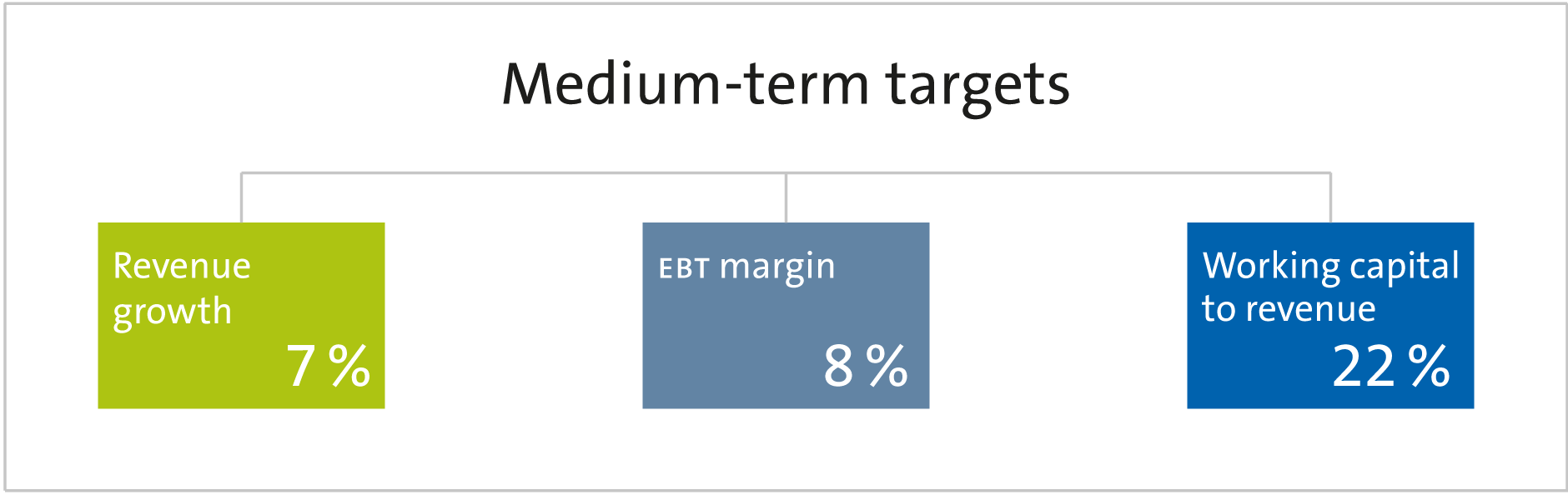

7/8/22 medium-term target unchanged

Krones has set itself ambitious medium-term financial targets to consolidate its market position. 7/8/22 stands for:

- 7% average revenue growth per year

- 8% EBT margin

- 22% working capital to revenue ratio

Due to various challenges, however, such as continuously rising material and labour costs and ongoing heavy investment in the future of the business, it will take longer for the medium-term targets to be attained.

Leveraging market opportunities

For Krones to grow at a faster pace in the medium term than the global economy, which on IMF estimates is expected to show growth of about 3.5% in 2019 and 2020, we must make targeted use of market opportunities. Krones is therefore expanding in markets where beverage consumption shows above-average growth – most of all in Africa and Asia. A further growth driver is rapidly growing product diversity. Both beverage products and packaging are becoming increasingly diverse. Customers demand versatile machines and lines in response. Krones aims to profit from this attractive market segment with its technologically sophisticated products.

Alongside internal initiatives, acquisitions will also continue to con-tribute to growth. We made a number of further acquisitions last year, primarily in process technology. Just as important as acquiring companies is their rapid -integration. We aim to step up the further development of acquisitions in the Krones Group in order to promote ‘bought-in’ internal growth. In the medium term, around 2% of annual revenue growth is planned to come from acquisitions.

Innovation secures future growth

Innovation is the foundation for sustainable growth at Krones. Our customers are a source of ideas for new products and services. Equally, our workforce are known for their innovativeness. For Krones, customer benefit takes first priority in all innovation (see R&D, p. 53). Not only do we seek to score with new -products in the three key areas of process technology/beverage production, filling/packaging and intralogistics, we also aim to harness innovative after-sales service together with IT and digitalisation solutions for our growth targets.

One of our strengths lies in the long-term orientation of our innovation strategy. It frequently takes several years for our products to become established and capture the market. This requires persistence. But persistence pays, as plenty of examples demonstrate. An example is our extremely space-saving, high-performance ErgoBloc L, which we first presented at drinktec in 2011 and which, after a certain lead time, ultimately became a best seller. We already shipped our 250th ErgoBloc L in 2018. Our aseptic portfolio, which we have been building with new developments for several years, is now likewise gaining momentum. This is exemplified by the Contiform AseptBloc, which major customers are increasingly ordering and which we intend to position in the Asian and US markets this year.

Another key element of Krones’ innovation strategy is the establishment of -an innovation network. Working in close cooperation with universities, research institutes and start-ups, we aim to develop products and solutions for the digitalisation of the beverage industry. Product innovations are no longer created in isolation inside development departments, but in open networks incorporating expertise from other industries and disciplines.

Expanding our global footprint in the House of Krones

With the “House of Krones”, Krones has tailored its business model to -customer needs and to the state-of-the-art beverage plant.

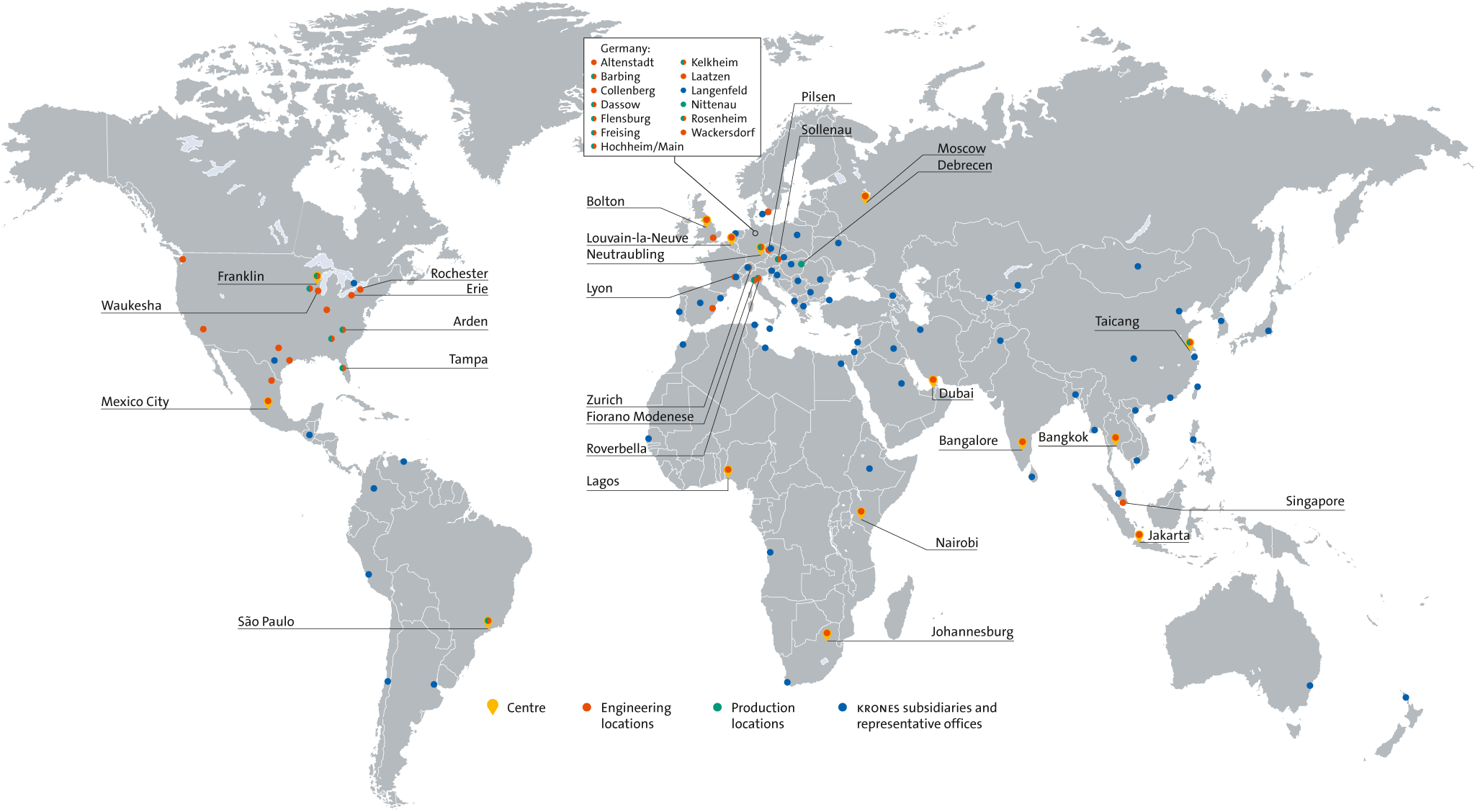

We aim to further strengthen our core bottling and packaging equipment segment. For this, we are going to expand our global footprint and increase -international value creation. A key step in this is our new production location in Debrecen, Hungary. There, we plan to assemble components, primarily for conveyor technology, with a 500-strong workforce from the second half of 2019. We will rapidly bring the capacity added at our facility in Taicang, China, to full utilization in the coming years. This will increasingly enable us to supply the Chinese and Asian markets from the region.

Bottling and packaging equipment, as the highest-revenue pillar in the House of Krones, is expected to grow further and will benefit from the increasingly demanding of customer requirements. These primarily relate to high system efficiency and flexibility. Krones is well positioned here with its technologically advanced products.

Krones takes the debate about plastic packaging very seriously. We have con-sequently provided lines for high-quality PET recycling for many years. We have ten systems already in operation at customers, and we continue to expect brisk demand. As well as being a pioneer in PET recycling lines, Krones also leads in the economical utilisation of plastics in the bottle production and the packaging technology.

The process technology pillar of our business is set to grow further in the -medium term with significantly improved profitability. We intend to improve order quality and hence profitability in the high-revenue breweries business. Expanding local capacity will enable us to respond even better to market needs. A further key to this segment’s long-term success lies in expanding its regional structure and establishing international hubs. Medium-sized and smaller orders in particular – which we plan to focus even more in the future – can be met more quickly and more cost-effectively from a regional base. This extends all the way from quotation, purchasing and engineering through to assembly and management. We plan to establish all of these capabilities in our hubs around the world. The acquisitions of W.M. Sprinkman Corp., Trans-Market and -Javlyn in the USA give us a strong presence in this segment in North America. We are well positioned in process technology in China following the acquisition of Shanghai Xiatong Equipment. In the -medium term, we also plan acquisitions to strengthen our presence in other -regions.

The intralogistics part is a further key pillar in the House of Krones and an important element of the digital beverage plant. This is an important area for our customers because it allows them to control better the complexity in their products and optimise material flow management. Intralogistics also helps to manage and distribute the increasing number of different packaging variants.

Krones is well positioned in intralogistics with System Logistics and our in-house specialist for sophisticated intralogistics projects. In order to exploit the market’s strong growth opportunities, Krones intends to further expand both its international reach and its product portfolio in this area.

Actively shaping the digitalisation of the beverage plant

The digitalisation of beverage plants offers huge opportunities in the medium to long term. Krones is in a very strong position as a full-service supplier, as we are able to capture the material and data flows along a customer’s entire production process. The captured data can be used to develop new LCS products and services that create sustained added value for customers. An example is predictive maintenance of machines and systems using sophisticated data analysis. This avoids customers expensive downtime, as production data analysis enables problems with components to be detected at an early stage.

We pool our digitalisation capabilities in our subsidiary Syskron. This now has a workforce of some 180 employees, who use the latest technologies to develop digitalisation solutions for the beverage industry that create measurable added value for customers. Connected Line is an excellent example.

The digitalised line provides both operators and Krones with valuable information round the clock, thus enabling improvements in system efficiency. Our Share2Act platform – a network linking all employees, machines and IT systems involved in production – helps streamline customer processes, shorten lines of communication and reduce downtime.

The company will maintain its high level of investment in digitalisation going forward. Syskron and its agile subsidiaries will continue to develop attractive software solutions and viable digital business models and establish them as quickly as possible in the food and beverage industry.

Price increases and expansion of the company’s global footprint to enhance profitability

We did not achieve our profitability targets in 2018. The main reason for this was the more rapid increase in personnel and material expenses. Expenses for reorganisation and acquisitions also had a negative impact on earnings. Cost of materials went up because the booming economy enabled suppliers to push through substantial price rises. At the same time, selling prices in the markets served by Krones have remained stable for years. To continue delivering innovative products and services at top quality despite increasing material and -labour costs, Krones raised the prices for all bottling and packaging machinery and for process technology by an average of 4.5% as of 1 May 2018. These price rises are necessary in order to partially offset the cost increases.

Krones Global Footprint

Despite the setback in 2018, Krones plans to raise profitability in the years ahead. Also expanding our global presence in bottling and packaging equipment is an important part of this process. We currently generate a small share of added value outside Germany, even though -almost 90% of revenue comes from abroad. Establishing a supply chain in China and Hungary will enable us to reduce personnel and material costs in the medium term.

With the next stage in modularising the products in our core segment we want to reduce the substantial rise in the prices we pay for materials. Firstly, we will further increase modularisation and thus reduce the complexity of our machines and lines. That should result in a lower material cost input. Secondly, we will simplify the design of our modules so that local suppliers will also be capable of meeting our requirements in the medium term. That will increase competition and should lead to more attractive purchase prices.

Our service business is important to the profitability of Krones. Nearness to customers is the key success factor here. We will therefore further reinforce our global network of service and sales offices. The challenge for Krones here is recruiting and retaining enough well-qualified people from local regions. -Krones is consequently investing significantly in training and development for local employees in order to counter the relatively high employee turnover rates in emerging markets.

Strong growth investment in Germany and internationally

To remain competitive for the long term, Krones must invest – both in its German locations and in its global footprint. In Germany, we intend to invest around €190 million in the next few years. We plan to digitalise and automate internal production operations, processes, -organisation and logistics as far as possible for substantial gains in productivity and -efficiency. As the high level of investment in Germany shows, Germany remains Krones’ central location for the development of innovative machines, lines and services.

However, we also plan substantial investment abroad. In addition to the new factory in Hungary, which has already been mentioned, we also continue to expand our international service centres and engineering hubs.

Security from healthy financial and capital structure

Krones continues to have a sound financial and capital structure, with net cash and cash equivalents totalling €215 million and an equity ratio of 43.2%. The company has sufficient capital and financial headroom to finance growth investment and potential acquisitions and to provide shareholders with their share of the company’s success in the form of dividends. Our dividend strategy is to pay out 25% to 30% of consolidated net income to shareholders.

Improved working capital management

Krones is not satisfied with performance towards our third target, working capital as a percentage of revenue. This came to 27.3% in 2018, which in short of our 22% target. We consequently aim for progress in working capital in the years ahead and have defined short and medium-term measures for this purpose. This comprises larger customer downpayments, faster completion of on-site assembly and optimised inventory management. All this is for reducing the ratio of working capital to revenue. Less capital tied up in the operating business means more capital for investment. For each percentage point by which we improve this ratio, our liquidity improves by around €40 million.

Workforce the foundation of lasting success

Our workforce is the key for the success of Krones. They are responsible for customers’ satisfaction with our products and services.

Krones consequently invests significant in training and employee development. But we also need to make even more efficient use of the knowledge and the networks that are already there within the Krones Group. Every decision that is delayed and every piece of information that is lost costs valuable time. By using direct communication channels, we succeed in keeping up with rapid change in globalised and digitalised markets.

Krones will continue to expand the international workforce in the coming years in order to use market growth opportunities. We specifically plan to step up recruitment for Krones in the emerging markets. With our training centres in Africa, China and South America, we already have a good basis in this regard. The more people we recruit for our international locations from local regions, the closer we are to our customers and markets. This allows us to identify trends and developments at an early stage and so increase customer satisfaction.

Employees in the emerging markets 2013 – 2018

| Year | South America | Africa | Asia | CIS/Eastern Europe | China | Total |

|---|---|---|---|---|---|---|

| 2013 | 485 | 339 | 400 | 132 | 325 | 1,681 |

| 2014 | 501 | 363 | 453 | 136 | 385 | 1,838 |

| 2015 | 519 | 376 | 502 | 147 | 451 | 1,995 |

| 2016 | 549 | 386 | 602 | 155 | 508 | 2,200 |

| 2017 | 581 | 393 | 734 | 172 | 608 | 2,488 |

| 2018 | 637 | 452 | 830 | 213 | 716 | 2,848 |

Krones will also continue to invest in the workforce in Germany and Western Europe. Workforce growth in this region will be at a lower rate, however.

Krones’ management system

Krones’ management primarily uses the following financial performance indicators to steer the group and its two segments:

- Revenue

- EBT margin (earnings before taxes in relation to revenue)

- Ratio of working capital to revenue

In order to strengthen our market position and utilise economies of scale, we aim to achieve revenue growth above the market average.

Earnings before taxes (EBT) are an important earnings indicator. Out of EBT, the group pays taxes and dividends and makes investments and capital expenditures. Profitability, measured as the EBT margin, is among our key targets and parameters. The EBT margin indicates the company’s profitability in relation to revenue. For the group, we calculate the target margin as the weighted average of the two segments.

Our third major performance indicator is working capital to revenue, which is calculated at group level. Working capital is calculated as follows: (inventories + trade receivables + prepayments) – (trade payables + advances received). The result indicates how much capital is needed to finance the generation of revenue. The lower the number, the less capital is tied up in operations and, thus, the more financial possibility the company has to use its cash and cash equivalents for other purposes.

Other financial key performance figures

In addition to the above, a further important performance indicator for Krones is EBITDA, which is earnings before interest, taxes, depreciation and amortisation. We take further guidance from the development of free cash flow (cash flow from operating activities less cash flow from investing activities) and ROCE (return on capital employed, the ratio of EBIT to average capital employed).