Krones currently finds itself in an unusually challenging business situation. Except for the crisis year 2009, the company’s performance trend has mainly been one of profitable growth. We continued to deliver respectable revenue growth in 2018 and 2019. However, Krones has recently seen a significant decline in profitability. Krones’ strategy is therefore focused on resolutely implementing the defined measures in order to set the company for success.

Krones serves an attractive market. Our market is growing stably because demand for packaged beverages and foods is rising. The market benefits from megatrends such as world population growth, a growing middle class in emerging economies and increasing urbanisation. In the long term, we expect market growth to be above global GDP growth.

With its full global portfolio of products and services, Krones is well positioned to profit from the market opportunities. The company provides customers in the liquid food industry with everything they need from a single source, from beverage production to filling to packaging. Intralogistics solutions, information technology and high-quality after-sales service round out the portfolio.

As the recent past has shown, the market not only offers opportunities and is not immune to current developments in the global economy. Trade conflicts, political uncertainties and economic crises in individual countries and regions, together with the sometimes highly irrational and emotionally charged plastics debate, make for uncertainty among our customers. Competition for orders will remain intense and the targeted price increases will be hard to push through. Digitalisation will also require high levels of investment.

Krones has ambitious medium-term goals

From 2020, Krones will use the EBITDA margin instead of the EBT margin as the target figure for profitability. This is because EBITDA (earnings before interest, taxes, depreciation and amortisation) is closer to cash flow and more comparable because it does not include depreciation and amortisation, financial income/expense and taxes. Our medium-term target of 6–8% for the EBT margin corresponds to an EBITDA margin of 9–12%. To consolidate its good market position and have sufficient headroom for capital expenditure, Krones has set itself ambitious medium-term financial targets.

- 2% to 5% average organic revenue growth per year

- 9 to 12% EBITDA margin

- 22% to 24% working capital to revenue ratio

Various challenges – such as rising material and labour costs, the plastics debate, and also general -economic uncertainty – meant that we did not reach our original targets for 2018 and 2019. Despite increased market volatility, Krones sets ambitious medium-term targets. However, Krones will take longer to attain those targets. The company regards a period of three to four years as realistic. During the reporting period, we launched many measures with which we want to set the Krones team for success. Now it is a matter of resolutely implementing them.

Profitability improvement: measures in progress

To remain competitive for the long term, Krones must generate sustained and sufficient earnings. With an EBT margin of 2.8% in 2019 (excluding expenses for provisions to reduce labour costs and impairments for portfolio streamlining in a total amount of about €70 million), we are still short of our target. In the second half of 2019, the company therefore initiated medium-term alongside short-term measures to improve earnings. The measures are divided into three pillars.

Medium-term measures and impacts

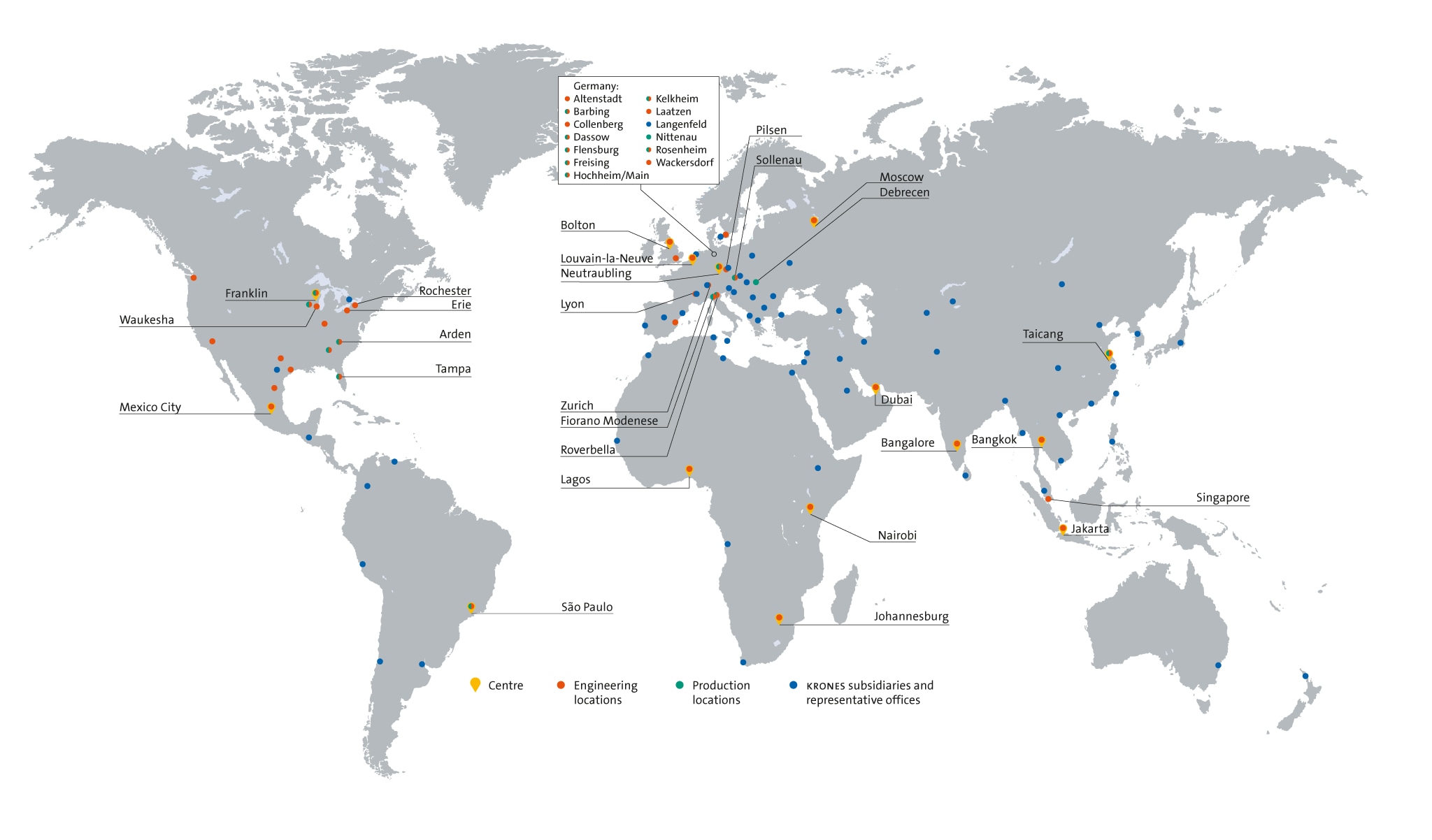

Structural measures make up the largest share of the action package. Most of all, they include expansion of Krones’ global footprint. We currently generate only a small share of added value outside of Germany even though almost 90% of revenue comes from abroad. In the short and medium term, therefore, we plan to relocate parts of the value chain to best-cost countries. The most important project here is our new factory in Hungary. This is scheduled to go into full operation with 500 employees in the second half of 2020. Production has also been expanded in China. In total, about 600,000 hours of production time are to be implemented in Hungary and China by the end of 2020. Added to this are 200,000 design and planning hours in future in the Czech Republic, India, Hungary and China.

In addition, group processes and resources are to be further optimised and organisational units streamlined. In Germany, the structural measures result in a reduction of 500 jobs: 200 in the reporting period and 300 in 2020. About 200 jobs will be reduced internationally by the end of 2020. The new process technology locations established in the USA, China and India as a result of acquisitions in recent years will also contribute positively to earnings.

Krones is also expanding its global footprint to counteract the rise in material costs. Best-cost country (BCC) sourcing secures significant reductions in procurement costs. Krones has already successfully implemented this in Taicang, China. Furthermore, we have established a supplier network in India, Taiwan, Thailand and Turkey. We will rigorously continue with the international procurement measures we have implemented so far.

Optimising the House of Krones portfolio

With the “House of Krones”, Krones has tailored its business model to customer needs and to the state-of-the-art beverage plant. This approach will not change. We will, however, continue to make individual adjustments and optimise the portfolio. In the Process Technology pillar, we will begin by making the beverage production business a legally independent unit. We can then better assess how this business is developing on a standalone basis, specifically with regard to the different types of beverages. Currently, we do not plan any acquisitions in process technology. We are concentrating on integrating the acquisitions made in recent years in the USA and China.

The core bottling and packaging equipment segment is affected by the critical plastics debate. In our opinion, PET has a wrongly bad reputation. PET plastic has a major advantage over other types of packaging such as glass: It is significantly lighter than other materials and PET bottles have a correspondingly smaller ecological footprint in long-distance transportation. This is a key reason why PET continues to be the fastest growing packaging material worldwide.

It is often overlooked that plastic packaging can in fact be sustainable. This requires packaging materials to be produced in a resource-efficient manner and kept in a closed cycle. Krones’ technologies and products meet both of these criteria. We provide material-saving container design, low-energy production and used plastics recycling. With our high-quality PET recycling -systems that turn used PET bottles into raw material for new ones, we support a sustainable material cycle.

Extending the company’s good position in glass and cans

In its core segment, Krones will continue to strengthen the glass and cans product portfolio. As the megatrend towards packaged beverages continues, weak demand for PET packaging would mean greater demand for other types of packaging such as glass and cans. Krones has always been well positioned here with a broad product range for both packaging types. The company added a key innovation to the glass portfolio during the reporting year with the Craftmate G glass bottle filler.

As well as expanding the broad-based bottling and packaging segment with further attractive products, we are also going to strip the portfolio of less profitable activities and technologies in order to focus our capital on the most attractive investments.

The third pillar of the House of Krones, intralogistics, continues to see good -demand for our products and services. Intralogistics is a major element of the digital beverage plant. It is an important area for our customers because it -allows them to optimise material flow management. The priority in this area is on managing the rapid rate of growth and pushing ahead with internationalisation. For this purpose, we have pooled all intralogistics activities in System Logistics and made this a legally independent unit. This enables us to react quickly and flexibly to market requirements.

Price increases important for sustained business performance

Price increases are necessary in order to partially offset rising labour and material costs. We will implement our goals here by means of increased price discipline. For 2020, we consider an earnings contribution of €10–20 million to be realistic from higher prices.

Digitalisation offers huge opportunities in the medium to long term

In digitalization, Krones has the major advantage as a full-service supplier of being able to capture all material and data flows around the clock throughout the entire beverage plant production process. Combining the captured data with the knowhow of our workforce, some of whom have decades of experience, we develop new products and services – primarily for the life cycle services (LCS) subsegment – that significantly improve plant efficiency. In this way we create lasting added value for customers. The aim is to develop digital business models and establish them as quickly as possible in the food and beverage industry.

Overall, investment in digitalization will continue to impact profitability in the next few years. Krones sees good market opportunities here in the medium to long term.

High-growth service business strengthens profitability

Our service business is important to the profitability of Krones. The key success factor for the LCS business is and remains availability, meaning how quickly the service team can solve a customer’s problems on the spot. That means both technicians and spare parts must be as close to the customer as possible. To ensure this, we will further reinforce our global network of service and sales offices. Alongside availability, another major growth driver for the service business takes the form of innovative products and services supported by innovation in digitalization.

The service market has considerable further growth potential for Krones in the medium to long term. A major asset for Krones is the large installed base of about 40,000 machines in customers’ factories. Our LCS team so far serve about 60% of our installed base. We are going to raise this figure in the years ahead by convincing customers of the benefits of our services, which enable them to significantly increase productivity.

Capital expenditure returning to normal levels

To remain competitive for the long term, Krones must invest – both in its German locations and in its global footprint. In contrast to the strong growth investment of the preceding years, capital expenditure will be scaled back to normal levels in the short to medium term. Most capital expenditure in Germany is to be on IT infrastructure. Germany remains Krones’ central location for the development of innovative machines, lines and services.

Elsewhere, Krones will invest in the organisation and in integrating the acquisitions made in recent years. We will also further expand our IT internationally.

Innovations: key investment for the future

Innovations secure our company’s future and are the basis for sustained growth. For this reason, even in economically more challenging times, Krones will maintain its comparatively high spending on research and development.

New products and services must provide added value for customers in order to be a market success. Close contact with our customers gives us important input for innovations and improvements. Based on customer needs, we work together to develop ideas for new products and services. We also generate ideas of our own by thinking out of the box. Close contact and good working relationships with universities, research institutions and startups also help us in this regard.

Alongside digital innovations, solutions at Krones focus on environmentally compatible, cost-cutting, flexible and operator-friendly machines and products.

Security from solid financial and capital structure

With insufficient cash flow from operating activities in 2019, free cash flow and net cash and cash equivalents also decreased significantly due to the high level of capital expenditure. The equity ratio was a comparatively satisfactory 41.3%. Krones therefore retains a robust financial and capital structure. The company has sufficient financial headroom to finance growth investment and potential acquisitions and to accord shareholders their due share of the company’s success in the form of dividends. Krones’ dividend strategy is to pay out 25% to 30% of consolidated net income to shareholders.

Ongoing strong focus on free cash flow

Krones continues to focus on free cash flow. This fell significantly in 2019 because of the decline in the operating business, above-average capital expenditure and a rise in working capital. We will work hard on all three of those --parameters in the coming years. First of all, as described earlier, we will regain our former profitability. After several years of strong growth investment, we will return capital expenditure to normal levels. A clear focus in future capital expenditure will be on whether business units are generating sufficient cash. This criterion will also be a deciding factor in portfolio streamlining. We are holding back on acquisitions. No major acquisitions are planned for the short or medium term. However, we have the capacity to act on attractive acquisition opportunities at any time.

The greatest potential for improving free cash flow consists of reducing working capital. Krones is not satisfied with working capital as a percentage of revenue, which is our third target. This came to 26.9% in 2019, which is well short of our 22–24% medium-term target. The lower our working capital, the more capital we have available for other uses. For each percentage point by which we improve this ratio, our free cash flow and therefore our available resources grow by around €40 million.

The main burden on working capital is the high level of customer receivables and contract assets. Krones will shorten the timespan from delivery to invoicing. First of all, on-site assembly and acceptance are to be completed sooner. Secondly, contracts with customers need to be drafted in such a way that performance rendered can still be invoiced in the event of delays for which we are not responsible. Overall, it is planned for trade receivables to grow below average in the next few years relative to revenue. There is also room for improvement in trade payables, but not on the same scale as in receivables.

Workforce the foundation of lasting success

The workforce is pivotal to Krones’ success – especially at times when conditions become more challenging and there is a break in the continuous upward trend. Our customers buy from Krones because they trust in the company and its workforce. It is the workforce who are responsible for customers’ satisfaction with our products and services. And customer satisfaction is a highly decisive factor when competing for orders.

We had to take various measures due to negative developments during the reporting period – including major job cuts affecting several hundred employees in Germany and elsewhere.

The company will continue to invest heavily in employee training and development in order to maintain workforce knowhow at the same very high level.

Krones will further expand the workforce in the years ahead where this contributes to profitability. To take advantage of market growth opportunities in emerging economies, we need more employees in the regions where customers are located. We currently employ about 24% of the workforce in emerging -markets. Given corresponding market growth, we will further increase that percentage.

Krones’ global footprint

Krones’ management system

Krones’ management primarily uses the following financial performance indicators to steer the group and its two segments:

- Revenue

- EBT margin (earnings before taxes as a percentage of revenue)

- Working capital as a percentage of revenue

In order to strengthen our market position and utilise economies of scale, we aim for above market average revenue growth.

Earnings before taxes (EBT) are an important earnings indicator. It is out of EBT that the group pays taxes and dividends and makes investments and capital expenditures. Profitability, measured as the EBT margin, is among our key targets and parameters. The EBT margin indicates the company’s profitability in relation to revenue. For the group, we set the target margin as the weighted average of the two segments. From 2020, we are replacing the EBT margin with the EBITDA margin (earnings before interest, taxes, depreciation and amortisation as a percentage of revenue). The EBiTda margin indicates the company’s profitability in relation to revenue, irrespective of the tax rate, financial income/expense and depreciation and amortisation.

Our third major performance indicator is working capital to revenue, which is calculated at group level. Working capital is calculated as follows: (inventories + trade receivables + contract assets) – (trade payables + contract liabilities). This figure indicates how much working capital is needed to finance revenue generation. The lower the number, the less capital is tied up in operations and the more financial leeway the company has to use its cash and cash and cash equivalents for other purposes.

Other financial key performance figures

In addition to the above, a further important performance indicator for Krones is free cash flow (cash flow from operating activities less cash flow from investing activities). We take further guidance from the development of EBT (earnings before taxes) and ROCE (return on capital employed, the ratio of EBIT to average capital employed).