Krones Group Annual Report 2022

“Krones has done a good job so far of mastering the global challenges. With our new target picture, “Solutions beyond tomorrow”, we are contributing to a livable, sustainable and successful future.”, Christoph Klenk, CEO

Strategy and management system

The 2022 financial year has shown that Krones in its entirety is well positioned to master crises.

On top of the Covid pandemic, the global economy was also impacted in the reporting year by the Russia-Ukraine conflict and by bottlenecks in procurement and energy markets. We nevertheless generated high growth in revenue, order intake and earnings in 2022.

Krones benefited from the company’s great flexibility, the enormous creativity of the workforce, our innovative strength and our very good reputation among customers. During the pandemic, we built further on that reputation by continuing to -deliver what we promised even at this challenging time. As a key advantage here, Krones was upfront with customers about projects taking longer due to the pandemic restrictions and the difficulties in global supply chains. As a result, we were able to complete orders largely on time and in the usual quality, despite the difficult conditions.

Krones serves an attractive market. This is growing stably because demand for packaged beverages and foods is rising. The brief dip during the 2020 pandemic year has already been more than made up for by strong growth in the two years that followed. Megatrends such as global population growth, a growing middle class in emerging markets and increasing urbanisation are driving demand. Market growth is also driven by the digital transformation and sustainability. As the internationally leading supplier of beverage filling and packaging machinery with a full range of products and services worldwide and the two complementary segments of Process Technology and Intralogistics, Krones is very well positioned to take advantage of the market opportunities.

Costs and growth remain two core focuses

The good business figures do not cause us to be too euphoric by any means. We know that the political and economic uncertainties are still at a high level. These have already led to a cooling of the global economy. It is all the more -important for us to further strengthen our resilience and agility for crises in -order to safeguard the future of our business. To achieve this, we must continue to improve Krones’ cost base and organisational structure. This continuous improvement process demands great discipline from the entire Krones team. At the same time, we will continue to seize the opportunities presented by our growing market. We took a major step forward here in the reporting year with the new Krones target picture, “Solutions beyond tomorrow” (see next page).

Implementation of higher selling prices

Due to our innovative solutions, excellent project work at customers and generally rising costs, Krones succeeded in implementing price increases during the past financial year. Although competition remains intense, we will continue to adhere to our pricing strategy. The higher order backlog gives us the security we need to maintain our pricing discipline in the event of a potential downturn in demand.

Better cost structure makes Krones more resilient

The cost reduction measures launched in past years are taking effect. In 2022, for the first time, the workforce reductions implemented in 2019 and 2020 are reflected in the figures for a full year. We will continue to optimise and accelerate our internal processes and workflows. Digitalising all business processes is a key part of this. We will also continue our ongoing cost reduction programmes in all areas. The aim is to further reduce the proportion of fixed costs, making us more flexible and resilient to future more volatile demand cycles.

An important element for Krones in achieving more favourable cost structures is expansion of the global value-added network. More international procurement and production gives us greater flexibility to respond to trade restrictions or regional supply chain issues. The company gains significant cost advantages from the establishment of its production facilities and the associated supply chains in Hungary and China. In the coming years, we will continuously increase the proportion of value added that the Krones Group generates internationally.

Exploiting growth opportunities with “Solutions beyond tomorrow”

In addition to resilience and agility, the Krones team also needs a clear goal to keep driving the company forward every day. That is why, in these challenging times, we have developed a new, ambitious target picture for the company: “Solutions beyond tomorrow”. Krones needs big and ambitious targets in order to keep evolving and be successful in the long term. With this new slogan, we aim to show – not only to the outside world but also internally – the direction in which Krones is heading: our company will contribute to a livable, sustainable and successful future.

Strategic focus

With the new target picture and changing customer needs, Krones has a clear strategic focus on sustainability, service quality and digitalisation. These three focuses also determine the strategic alignment of our three business segments.

Customers’ needs have changed in recent times, notably with regard to sustainability and digitalisation. This creates major growth opportunities for Krones – in all three segments.

Sustainability: core focus for customers and Krones

As drinktec 2022 once again clearly showed, sustainability, climate change mitigation and resource conservation have top priority for our customers. With its products, Krones provides customers with the means for climate-friendly, circularity-oriented food and beverage production.

enviro products: important for customers’ climate targets

Our customers in the food and beverage industry have adopted ambitious environmental and climate targets. With its TÜV-certified, continuously improved enviro sustainability programme, Krones is ideally positioned as a supplier to help companies achieve their climate targets. Our customers have long benefited from the lower energy and resource consumption of our machines and lines. By 2030, Krones’ goal is for its lines and machines to save customers a further 25% in energy and resources compared to 2019. Krones expects the percentage of enviro machines in its order intake to nearly double from 38% in 2022 to around 70% in 2024. The company plans an 80% reduction in its own carbon emissions by 2030 relative to 2019. Krones already achieved almost half of this reduction target by the 2022 financial year. In addition, we committed in the reporting year to developing a net zero emissions target.

Significantly reducing plastic littering with circularity and recycling

A major problem for future life on our planet is rapidly increasing volumes of plastic waste. Krones wants to make a significant contribution to solving this problem. This ranges from material-saving packaging design to recycling used plastics. For the circular economy to work, returned PET must be recycled to a high standard and then reused as packaging. Over the next few years, many major customers will significantly increase the proportion of recycled PET (rPET) in their bottles – in some cases to over 50%.

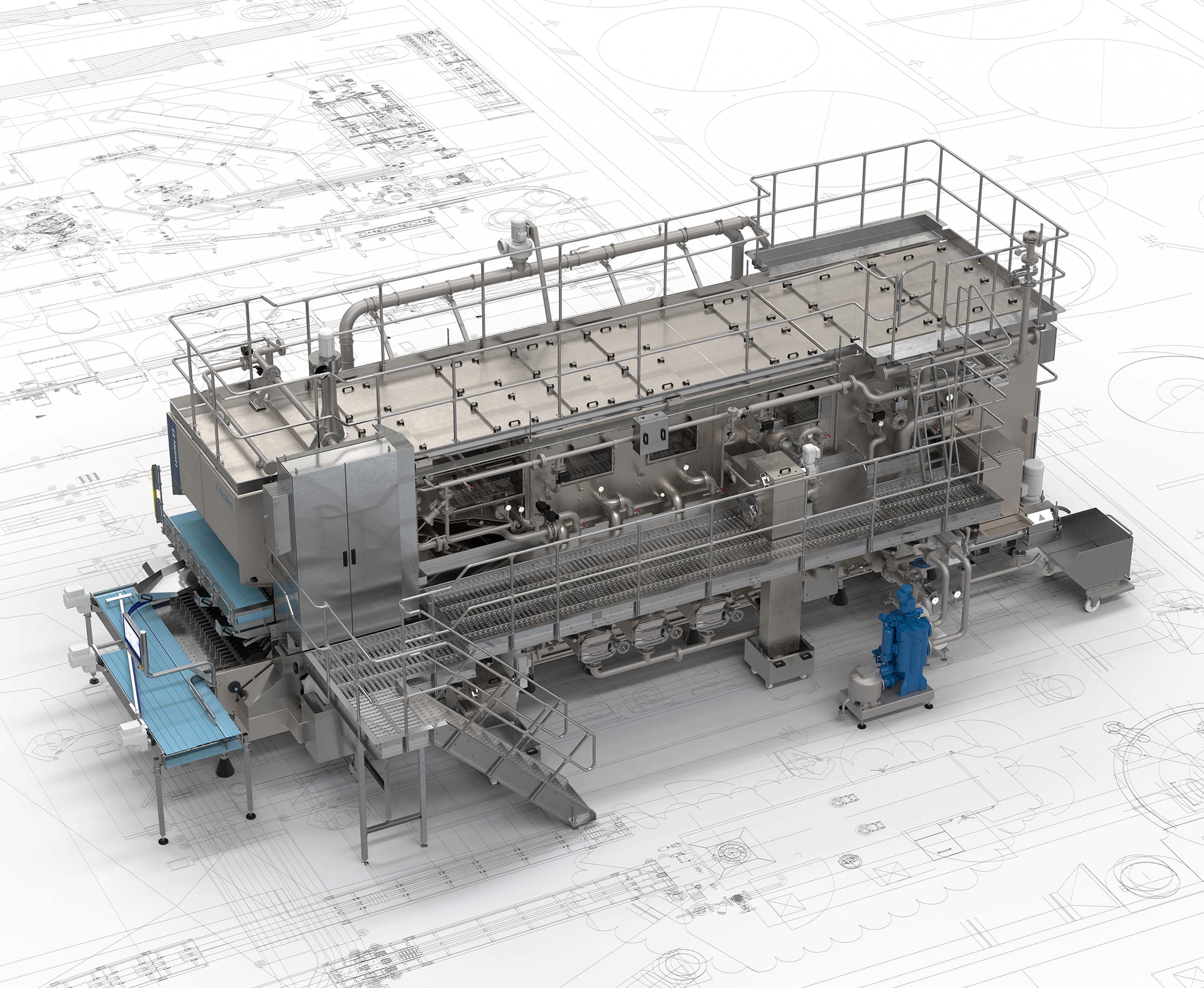

With its various MetaPure lines, Krones has key technologies for producing new PET bottles from used PET bottles in what is known as bottle-to-bottle recycling. MetaPure can also be used to recycle other packaging plastics (HDPE, LDPE, PP and PS). This prevents the loss of plastic as a valuable resource and significantly reduces the amount of plastic waste.

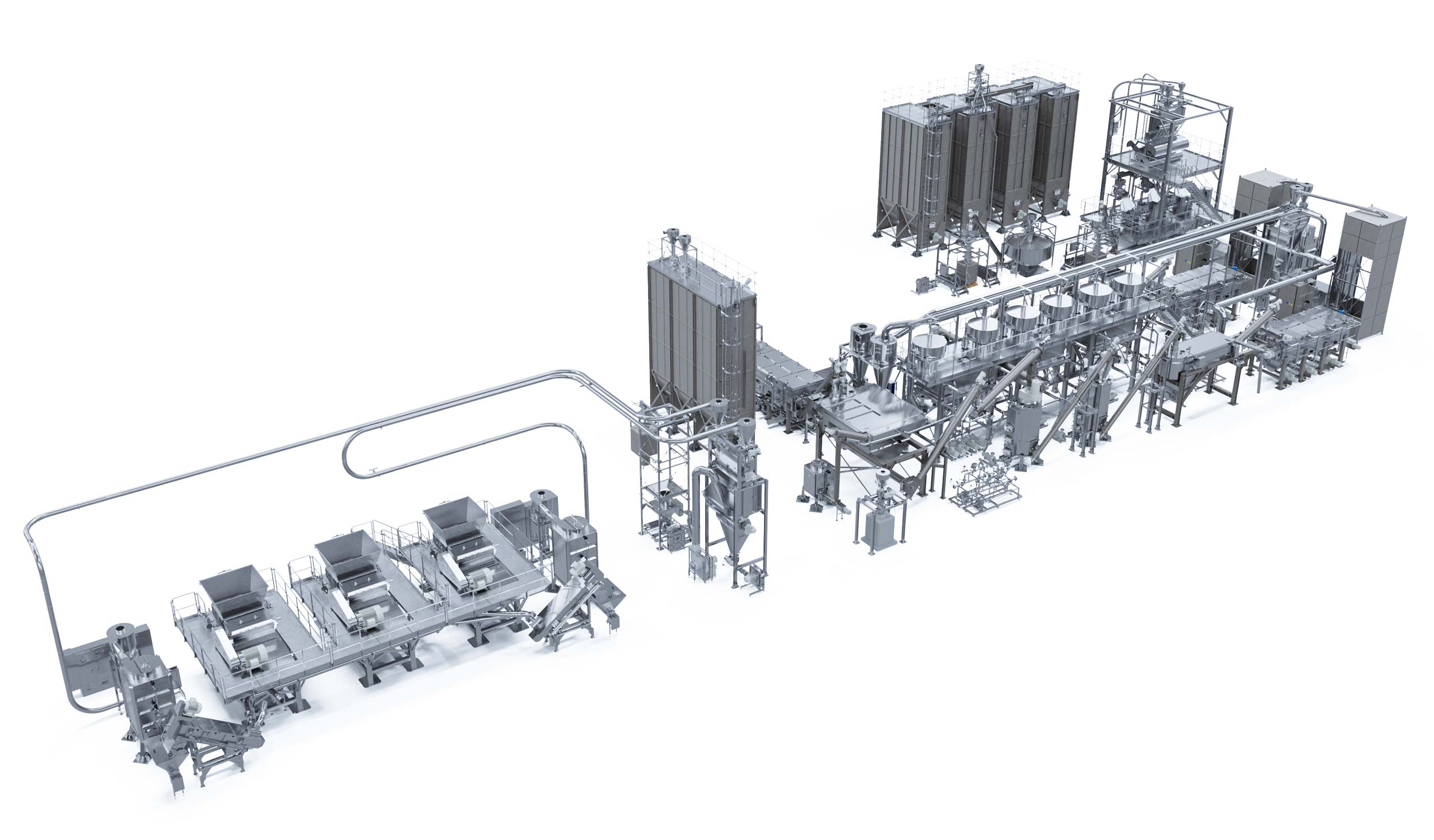

Sustainably feeding the world with alternative proteins

Today’s livestock production has an enormous carbon footprint. Providing people with high-quality plant protein as an alternative to animal protein is therefore an indispensable and valuable contribution to combating climate change. Analysts expect this market to grow by 15% per year up to 2030.

Going forward, Krones intends to play a major role in this up-and-coming market. Krones leverages its existing dairy expertise for the production of alternative plant-based dairy products (based on soy, oats, nuts, etc.) and already supports producers with the complete process technology. In the production of solid alternative proteins (meat substitutes), the company benefits from decades of experience in controlling biological conversion processes, such as fermentation. Many vegetable proteins are produced by adding enzymes and yeasts and then fermenting.

Digitalisation: the basis for new business models

The digitalisation of beverage plants is important for plant operators because it enables them to achieve further significant reductions in operating costs. Krones was an industry pioneer in digitalisation as in other areas, and benefits here from its line expertise – the interoperation of many individual machines and lines.

The company has combined all of its digital services on a single platform, Krones.world. This gives plant operators access to all digital services in one place. Krones has already been supply digital-ready machines and lines for some years. By using our digital services, customers improve the efficiency of their lines and cut costs. Krones’ goal is to support the entire plant life cycle with digital full-service centres, and to evolve from a machine and line manufacturer to a manager of beverage plants – from “Built by Krones” to “Managed by Krones”. It will implement this by way of service level agreements (SLAs). Under an SLA, Krones undertakes to provide a plant operator in the future with specified services in return for a service fee.

To combine its strengths in the dynamic field of digitalisation, Krones brought together all related activities Group-wide during the reporting period in Krones.digital. There, 450 software and IT engineers work exclusively on the development of digital products and services. A further approximately 1,000 IT specialists also work on digitalisation issues.

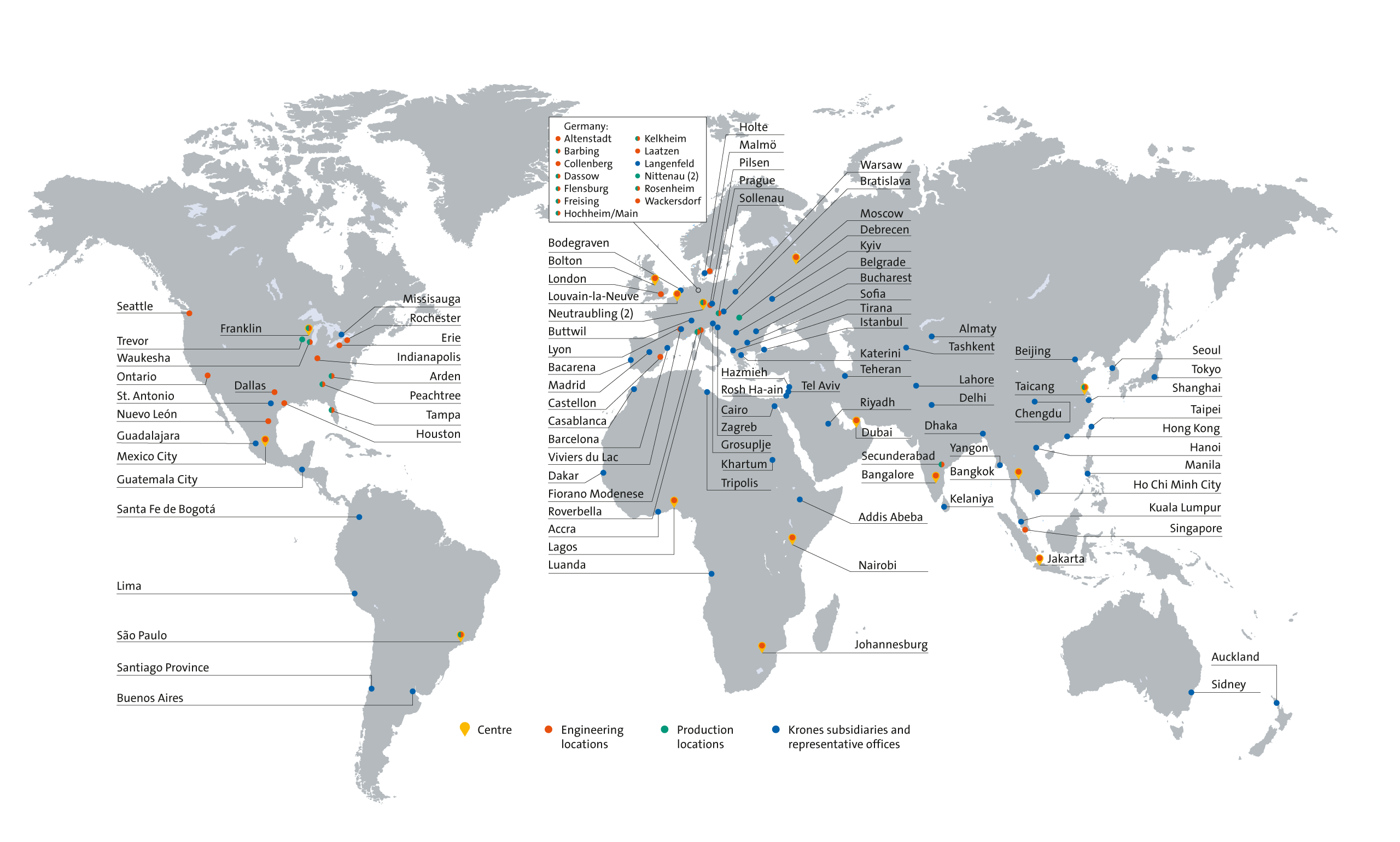

Close to the customer with a worldwide service network

Our approximately 3,000 local service staff around the world play a key role in the practical delivery of digital services. At our service companies in over 70 countries, they provide customers with support, remotely or in person. Plant operators therefore benefit not only from our digital knowhow, but also from our line expertise.

In addition, our worldwide LCS centres ensure fast delivery of spare parts. The basis for long-term growth in LCS business is the installed base, which is growing every year. There is additional potential in the share of managed lines supplied by Krones. Krones will continue to expand this going forward.

Further internationalisation supports growth

An additional growth driver for Krones is the further internationalisation of its service business. In addition to expanding its international production sites and supply chains, Krones will also invest in expanding its sales and service structures. Some 3,000 service technicians were in deployment worldwide in the reporting period. We aim to further increase this number by 2025.

The focus continues to be on emerging markets, where growth rates will remain above average. In particular, the Asia-Pacific region and Africa are expected to see the strongest growth over the long term. Within the emerging markets, Krones will continue to invest heavily in sites and employees from these regions. This enables us to respond quickly and directly to customer needs – a key factor in long-term customer satisfaction. In the reporting period, the company increased the size of its emerging markets workforce by 326 to 4,459.

Krones Global Footprint

Strategic focus in the segments

Filling and Packaging Technology: PET, cans and aseptics accelerating growth

Demand for PET lines has again increased significantly. For one thing, this form of packaging has the smallest carbon footprint. For another, the material can be used to produce a wide variety of different packaging shapes and designs. An important factor in the continued success of PET will be that, in a well-functioning circular economy, a large proportion of packaging in the future will be made from recycled PET (rPET). Krones is well positioned here with its recycling lines and can provide customers with optimum support in the handling of rPET.

The US hotfill market – aseptic filling under heat with high energy consumption – offers a further growth opportunity for the core segment. Krones intends to increasingly replace this process with its technologically advanced aseptic lines. These reduce both the carbon footprint and the quantity of plastic used. In the long term, the company aims to replace hotfill lines with Krones aseptic lines that can handle preforms and bottles with rPET content.

The continued development of Krones’ can filling lines in recent years is paying off. Krones is now once again the global market leader for filling beer and soft drinks in cans, and will be further consolidating this position with innovative line design and a new generation of fillers.

Process Technology: Profiting from new markets and energy-efficient solutions

The transformation of the Process Technology segment is progressing well. Going forward, in addition to the brewing and soft drinks business, we will also provide technologies for the production of plant-based proteins and energy-efficient beverage production solutions such as our Brewnomic. Both of these areas will see above-average demand growth as they help to reduce global carbon emissions. The expansion of the LCS and components business is expected to add to the segment’s growth and profitability.

Intralogistics: Market growing dynamically

Our newest segment is also benefiting from the sustainability megatrend. More and more, customers are demanding automation solutions as well as products that reduce labour and hence increase employee safety. Krones will also expand business in this segment with customer groups outside of the beverage industry, such as food distributors. An increased revenue share with automated picking systems and autonomous mobile robots is also expected to improve the segment’s profitability. As well as from the already dynamic market growth, Intralogistics will also benefit in the future from the expansion of services. The business, which has so far had a relatively strong focus on Europe, is to be further internationalised, particularly in Asia.

Innovations in all three segments lay the basis for long-term success

Attractive and innovative products and services are one of the key factors in maintaining high price quality. We will continue to deliver clear and measurable value to our customers. This is why all innovations focus on customer benefit. Customer feedback on the innovations we showcased at drinktec confirms our R&D strategy. Krones’ focus in innovation is on sustainability, digitalisation and system solutions. We present our R&D strategy and a selection of innovations from the reporting period on pages 73 to 80.

Strong finances and ambitious targets

Optimising working capital and increasing free cash flow and ROCE

As well as on profitable growth, Krones places a strong focus on free cash flow and return on capital employed (ROCE). A key factor influencing the development of both of these performance indicators is working capital. Less working capital tied up in the operating business means more liquidity for other purposes and so increases free cash flow. This is set to increase in the medium term.

Working capital also affects ROCE, our third financial key performance indicator, as it is part of capital employed. As working capital goes down, ROCE goes up – on the same EBIT. To achieve our ROCE target of at least 20% by 2025 (2022: 14.1%), we aim in the medium term both to further optimise EBIT and reduce the resources tied up in working capital.

Optimising working capital therefore remains a core task for our company. The company has taken steps to reduce working capital across all key parameters.

Healthy financial and capital structure provides stability and enables investment in the future

Krones has further strengthened its finances thanks to the very good business performance and the exceptionally high free cash flow in the reporting period of around €371 million, which resulted from the very large order intake during the financial year and the associated advance payments. At the end of 2022, Krones had a very solid equity ratio of 38.3% and a net cash position of €670 million. In addition, Krones has around €1 billion in undrawn credit lines. A very solid financial and capital structure is important in these volatile times. It gives the company and its workforce the necessary security and sufficient scope for investment in growth and the future.

Krones will continue to invest some 5% of revenue in research and development. In the years ahead, we will commit between 2.5% and 3.5% of revenue to capital expenditure on property, plant and equipment. This expenditure will mainly go on optimizing processes, production structures and IT systems. Internal sustainability projects (Scopes 1 and 2) will account for a significant proportion of capital expenditure in the current year.

Acquisitions are also part of Krones’ growth strategy. After selling prices have -returned to more normal levels, acquisitions of profitable, medium-sized companies will remain an option for Krones in the coming years, in order to take -advantage of opportunities in various markets. Acquisitions are aimed at strengthening the existing portfolio technologically and regionally, or at expanding target markets outside the beverage industry, such as the filling and packaging of food, pharmaceuticals and cosmetics. We began implementation of our acquisition strategy in the reporting period with the purchase of R+D Custom Automation in the United States. This enables us to expand our capabilities in the growing pharmaceutical market.

Krones will continue to share the company’s success with shareholders in the form of dividends. The company’s dividend strategy is to pay out 25% to 30% of consolidated net income to shareholders. In the past, it has tended towards the upper end of this range.

Krones is well on track to achieve its medium-term targets by 2025

At the end of 2021, the company adopted new ambitious targets for the period up to 2025.

Revenue is targeted to grow organically, meaning without acquisitions, by an average of 5% year on year until 2025 (2022: €4.2 billion). Including acquisitions, the company aims for revenue of at least €5 billion in 2025. Given the strong revenue growth in the reporting period and the large order backlog, Krones is confident of achieving this target.

Krones plans to continue growing profitably in future years. Only by generating sufficient earnings will we be able to capitalise on market opportunities and navigate potential crises. To this end, despite the steeply rising material and labour costs, the company targets an EBITDA margin of 10–13% in the medium term (2022: 8.9%).

Krones aims to significantly increase return on capital employed (ROCE) , as the capital efficiency target, to at least 20% by 2025 (2022: 14.1%).

Despite all the challenges, Krones currently sees more opportunities than risks for the achievement of its medium-term goals.

Krones’ greatest asset is its employees

The entire Krones team has done an outstanding job over the past few years. A variety of crises have further strengthened team cohesion and team spirit. Unique knowhow and the ability to stay level-headed but also agile and creative even in turbulent times are what make Krones resilient and successful.

All over the world, our customers appreciate the reliability of the Krones team. Despite all uncertainties and challenges, projects are completed on schedule. Our motivated and qualified employees secure the company’s future. For this reason, Krones will continue to make above-average investment in employee training and development in the coming years, and will strengthen its workforce, especially in the areas of IT and software, but also in the emerging markets.

Krones’ management primarily uses the following financial performance indicators to steer the group and its three segments:

- Revenue growth

- EBITDA margin (earnings before interest, taxes, depreciation and amortisation as a percentage of revenue)

- ROCE – return on capital employed – the ratio of EBIT to average net capital employed in the past four quarters. Net capital employed is defined as non-current assets (excluding goodwill and financial assets) plus working capital.

In order to strengthen our market position and utilise economies of scale, we aim in the medium term to achieve profitable revenue growth in all three segments.

Earnings before interest, taxes, depreciation and amortisation (EBITDA) is a key earnings performance indicator. Profitability, measured as the EBITDA margin (EBITDA as a percentage of revenue) is among our key targets and parameters. The EBITDA margin indicates the company’s profitability in relation to revenue, irrespective of the tax rate, financial income/expense and depreciation and amortisation.

Since the 2022 financial year, our third performance indicator has been ROCE (return on capital employed), calculated at Group level. This is the ratio of EBIT (earnings before interest and taxes) to average net capital employed in the past four quarters. ROCE is a very important profitability indicator for the capital markets. Return on capital employed shows investors how efficiently the company makes use of capital. Until the 2021 financial year, our third key performance indicator was working capital as a percentage of sales.

Other financial key performance figures

In addition to the above, a further important performance indicator for Krones is free cash flow (cash flow from operating activities less cash flow from investing activities). We take further guidance from the development of EBT (earnings before taxes), the EBT margin (EBT as a percentage of revenue) and the working capital to revenue ratio.