- Global economic outlook slightly weaker

- Good growth opportunities for Krones overall

- Executive Board expects increases in revenue and earnings before taxes in 2019

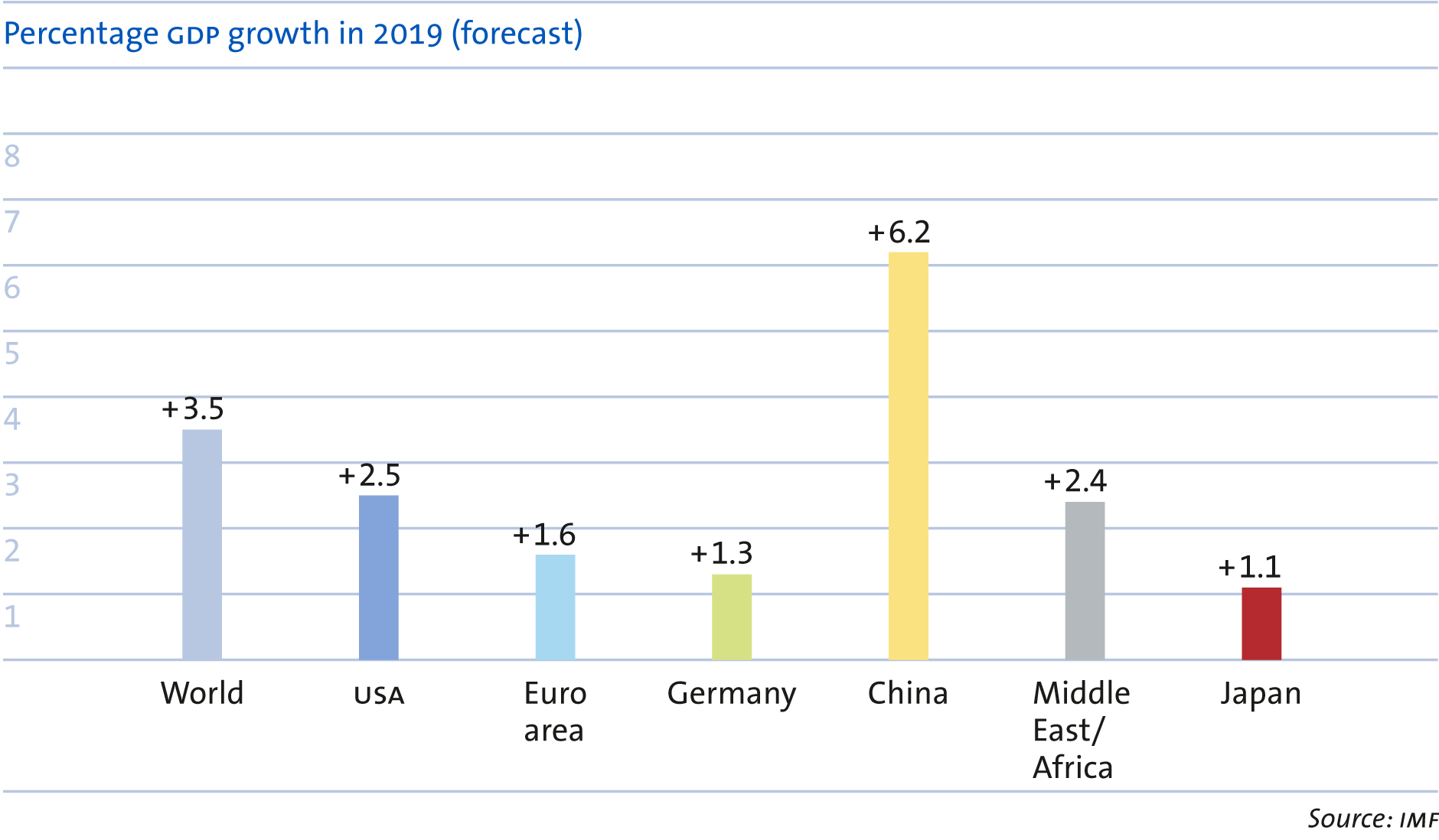

Global economic growth for 2019 estimated at 3.5%

In January 2019, the International Monetary Fund (IMF) lowered its forecast for global economic growth in the full year 2019 from 3.7% to 3.5%. The main reasons for this were the trade conflict between the USA and China and weakening growth rates in a number of countries, including France, Germany and China. At the same time, the IMF experts pointed out that risks are tilted to the downside. This includes volatility on financial markets and rising interest rates in the USA. However, the IMF does not believe that the global economy is headed for recession.

In emerging and developing economies, the pace of growth is likely to be a little slower in 2019 than in the previous year. This is mainly due to the Chinese economy. The IMF expects that China’s gross domestic product (GDP) will grow by only 6.2% in 2019 (previous year: 6.6%), partly due to tariff disputes with the USA. For the Middle East/Africa region, the IMF anticipates GDP growth of 2.4% in 2019 (previous year: 2.4%). In Latin America, the growth rate is expected to accelerate, with GDP growth of 2.0% relative to 2018 (previous year: 1.1%). In total, the IMF is forecasting 4.5% economic growth for the emerging and developing economies in 2019 (previous year: 4.6%).

The IMF expects economic problems in a number of industrialised economies in 2019, most of all in the euro area. Its experts lowered their growth forecast most sharply for Germany, which is labouring under production difficulties in the automotive industry and lower export demand. German GDP is expected to grow by just 1.3% in 2019 (previous year: 1.5%). For the euro area, the IMF anticipates GDP growth of 1.6% in 2019 (previous year: 1.8%). The IMF’s economists are more optimistic about the outlook for the US economy. With the positive effect of fiscal incentives, the world’s largest economy is expected to increase GDP by 2.5% in 2019 (previous year: 2.9%). For Japan, the IMF is forecasting 1.1% GDP growth (previous year: 0.9%). In total, the IMF forecasts 2.0% GDP growth for industrialised economies in 2019 (previous year: 2.3%).

Strong employment and moderate inflation rates support consumer spending

Consumer spending is a key factor determining the propensity of Krones’ customers to make capital expenditures and, consequently, the level of demand for beverage filling and packaging equipment. Low unemployment and inflation rates have a positive effect on consumer purchasing power and therefore support demand for packaged food and beverages. Thus, unemployment and inflation rates indirectly impact demand for Krones’ products and services. We do not expect either of these factors to have any negative effect on Krones’ business overall in 2019.

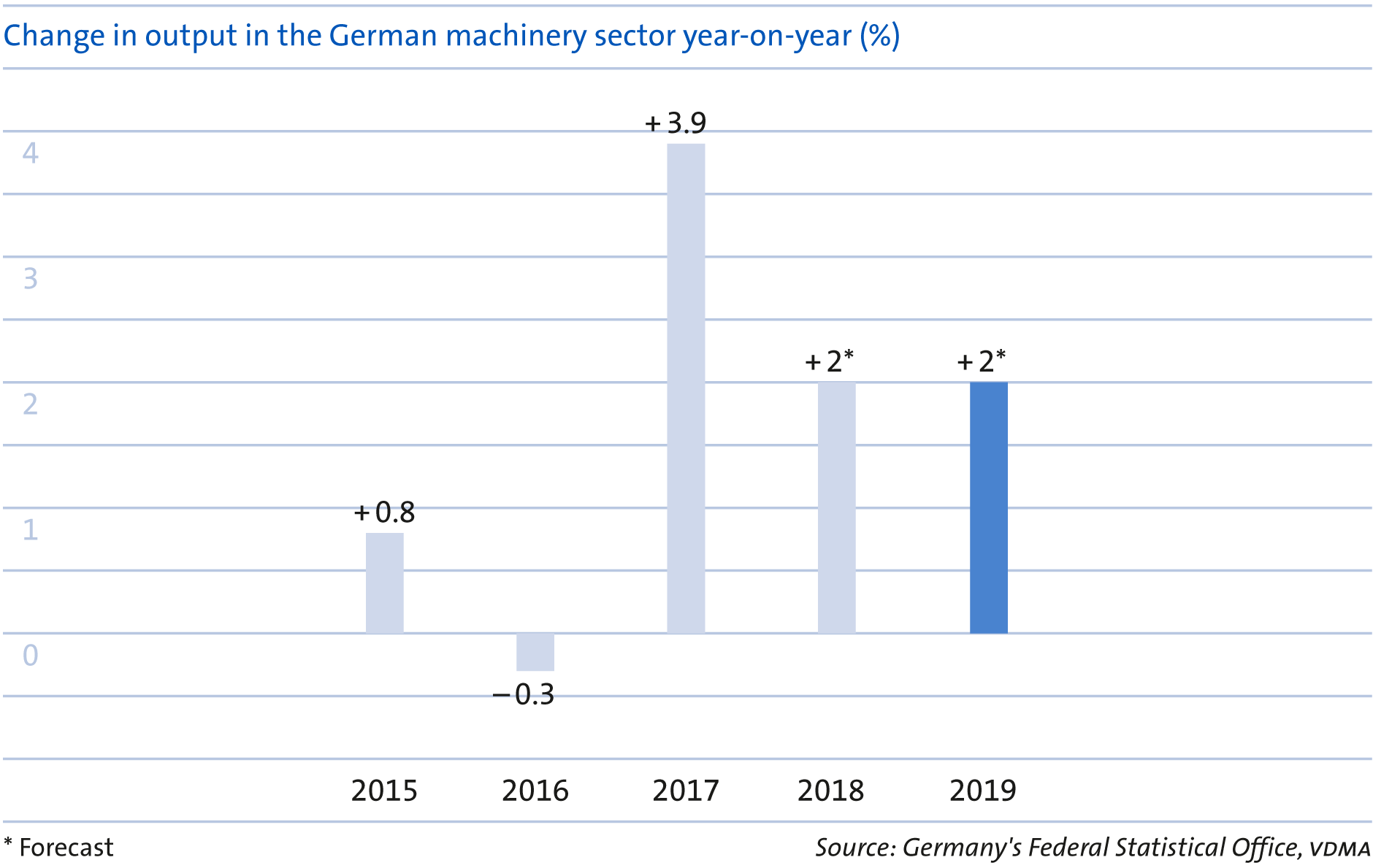

German machinery and industrial equipment manufacturers expected to slightly increase production

Germany’s Mechanical Engineering Industry Association (VDMA) expects that the economic growth slowdown in 2019 will also affect demand for capital goods. It also highlights unknowns such as Brexit and the trade disputes. Overall, the VDMA expects machinery and industrial equipment output to rise in value by 2% in 2019 (previous year: plus 2%).

The VDMA likewise projects 2% output growth in 2019 for the food and packaging machinery subsector to which Krones belongs.

Krones moderately optimistic going into 2019

With the year’s economic forecasts still positive overall, Krones is moderately optimistic going into the 2019 financial year despite political and economic uncertainties. The packaging machinery market is growing at a relatively stable pace because demand for packaged beverages and foods is rising on the back of multiple megatrends. Despite the positive environment, our market remains challenging. Competition for orders is intense, and customers are tending to gain in purchasing power due to mergers and acquisitions. Material and labour costs are not expected to ease in 2019.

Revenue and profitability to increase in both segments in 2019

The key to profitable growth for Krones lies in expanding our global footprint. Establishing a cost-optimised supplier network in the various regions plays a major part here. In addition, launching new products and services and further reducing costs remain important factors in order to grow further and improve profitability in both segments in 2019.

In the core segment, Machines and Lines for Product Filling and Decoration, Krones will further expand its global footprint in 2019. An important step here is the start of production at our new plant in Hungary in the second half of 2019. Innovation will also contribute to growth. To further offset the rising cost of material, we will continue to press ahead with modularisation. That enables us to secure better procurement terms and increase efficiency within the company.

For the core segment, Krones expects sales growth of around 3% in 2019, which is temporarily below the market growth rate due to the price increases. The EBT margin is expected to be around 7%.

In the Machines and Lines for Beverage Production/Process Technology segment, the focus is likewise on expanding our global footprint. By establishing additional international hubs, we aim to fulfil orders from within the various regions faster and more cost-efficiently. We plan to increase order quality and hence profitability in the high-revenue brewery business. Rapid integration of the 2018 acquisitions in this segment will enable us to unlock additional revenue and earnings potential.

The intralogistics business, which is part of the Process Technology segment, is once again expected to harness the good market growth opportunities and make a positive contribution to earnings this year. Intralogistics is becoming ever more important to our customers as it helps them properly manage and distribute the increasing diversity of packaging types and forms. It is also a major element of the digital beverage plant.

For the Process Technology segment in 2019, we are forecasting revenue growth by 5% and an EBT margin of approximately 1%.

Based on the prevailing macroeconomic outlook and the current expected development of the markets relevant to Krones, the company expects consolidated revenue growth of 3% in 2019.

In order to attain its medium-term corporate goals, Krones will continue in 2019 to work towards a future-ready global structure. The company does not expect any noticeable fall in material procurement prices in 2019; the same applies to labour costs. Krones’ price increases on all bottling and packaging equipment and for process technology with effect from 1 May 2018 are likely to have a slight positive effect on earnings in the 2019 financial year. Overall, Krones expects an EBT margin of around 6% for 2019.

Above all due to the focus on increases in the price level, in the current economic and geopolitical climate, Krones sees the management of its targets for 2019 subject to greater uncertainties than in the past.

For its third performance target, working capital to revenue, Krones expects a figure of 26% in 2019. We intend to reach this target by more intensive working capital management.

| Forecast for 2019 | Actual value 2018 | |

|---|---|---|

| Revenue growth | 3% | 4.4% |

| EBT margin | 6% | 5.3% |

| Working capital to revenue | 26% | 27.3% |