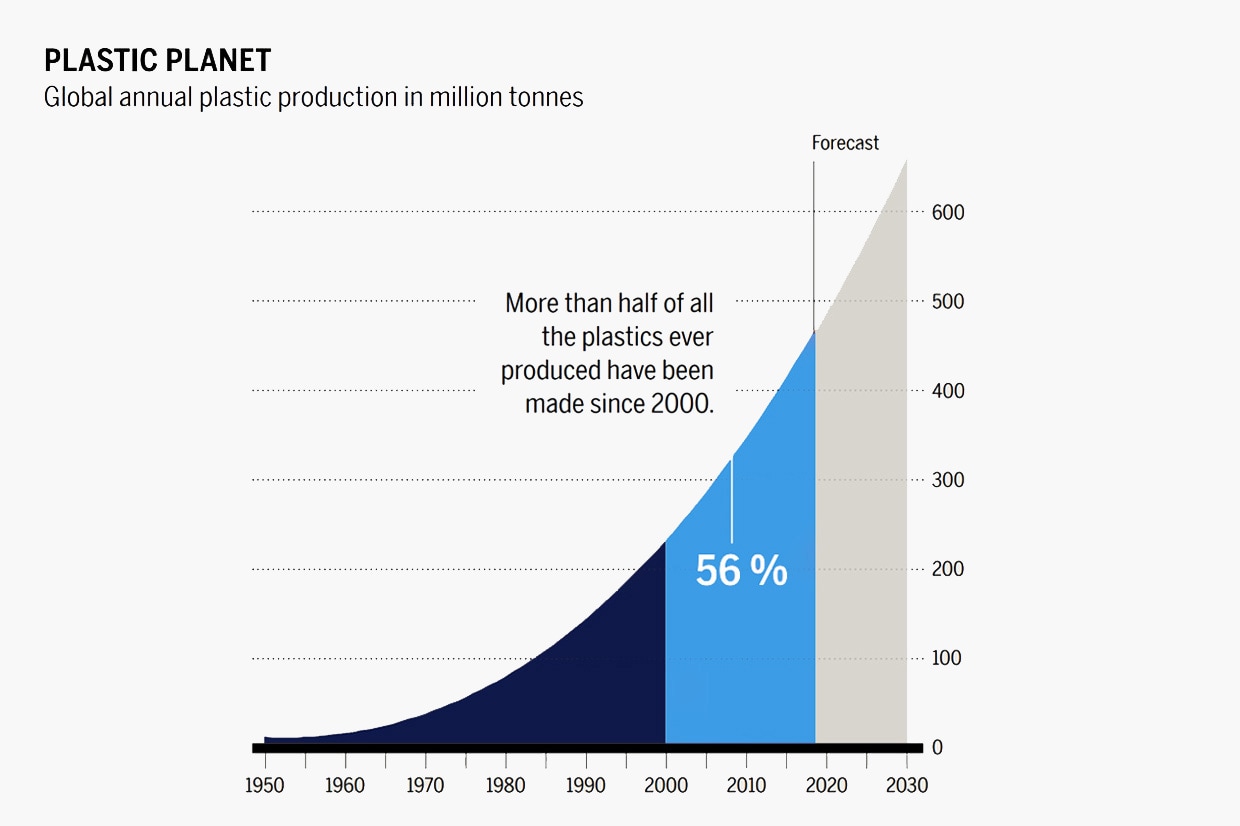

“Our planet is drowning in plastic pollution,” says the United Nations’ Environment Programme (UNEP). We are all familiar with pictures of mounting plastic rubbish tips and plastic waste in the oceans. Today, according to the OECD, the world produces some 460 million tonnes of plastic every year. It was only half as much just 20 years ago, and experts anticipate that the figure will rise to 800 million tonnes in less than the next twenty. Packaging makes up a good 40 percent of this quantity.

There is more and more plastic waste, while at the same time the market for recycled PET has been almost bought out. What's going on? How are governments reacting to the situation? Join us on a journey of discovery into the world of laws on plastic packaging and their recycling.

High-grade plastics can actually be directed pretty well into a closed loop. The bottle-to-bottle cycle, for instance, in which PET bottles are recycled into rPET bottles, is far advanced. The billions of PET bottles that end up on the world’s rubbish tips each year would be a huge source of raw materials. Since Krones offers beverage producers solutions for filling beverages in PET, among other things, but has also committed itself to sustainability, the avoidance, reduction, recycling and recirculation of plastic are key issues. Under the European Circular Economy Stakeholder Platform Krones has undertaken to meet quality targets covering different aspects of the packaging loop.

The markets for a circular economy in plastic are not functioning that well yet, with the proportion of recycled material in production not even reaching ten percent globally. Until recently many countries were exporting large portions of their plastic waste, mainly to Asia. Since China imposed import restrictions in 2018, however, and with other countries following suit, the problem of plastic waste has been on our own front doorstep. Governments are now trying to stem the flood with rules and regulations. They can call on a whole toolbox of taxes, subsidies, quotas, material permits or binding eco-friendly design standards. They can, for instance,

- introduce extended manufacturer responsibility and levy charges on non-recyclable plastic or on plastic waste, the dual system in Germany being one such example;

- prohibit certain plastic articles;

- raise recycling rates through

- mandatory collection quotas

- introducing deposit systems

In Germany, for instance, 98 percent of bottles requiring a deposit are collected and 45 percent of the collected PET bottles are recycled into PET containers

- encouraging markets for recycling products through mandatory quotas for the proportion of recycled material in the finished product;

- reducing the quantity of plastic through binding reuse quotas.

“Krones has the technologies for all these paths,” says Manuel Grund, who looks after the subjects of recycling and sustainability in Marketing and monitors how the market is moving. “We handle returnable and single-use PET as well as rPET, have recycling systems for a range of plastics, not just PET, and in LitePac Top also offer plastic-free secondary packaging.” He reckons that the statutory requirements which have been proposed or already implemented will entail significant changes for many companies, however, giving an example: “Some of the proposed legislation sets out very ambitious targets for collection and recycling quotas. Often, though, the authorities have little infrastructure for deposit systems, so the industry has to build logistics capacity before it can receive returns.”

EU as an example – on the road to a circular economy for plastics

Regulations in the EU have progressed relatively far on an international comparison. In 2018 it committed itself to a new plastic strategy with the aim of achieving the transformation to a carbon-neutral circular economy by 2050 as part of the Green Deal. Among the most important laws are the Single-Use Plastics Directive and the Packaging Directive.

Laws in the EU

The key regulations of the Single-Use Plastics Directive:

- Ban on certain single-use products such as straws or disposable crockery

- Mandatory collection quota for single-use plastic bottles (up to 90 percent in 2029)

- Mandatory recycled material share of 25 percent for PET bottles from 2025 and 30 percent for all plastic bottles from 2030

- Caps fixed to the bottle

The Packaging and Packaging Waste Directive (PPWD):

- One of the current requirements is that from 2030 all packaging must be either reusable, recyclable or compostable. For plastic there is a recycling quota of 55 percent from 2030.

- In November 2022 the Commission published the draft of a new European packaging regulation. Among its proposals are the following:

- From 2030 all packaging is to be at least 70 percent recyclable.

- From 2030 plastic food packaging is to contain at least 10 percent recycled material, single-use beverage bottles at least 30 percent, rising to as much as 50 to 65 percent by 2040.

- From 2029 all Member States are to have introduced deposit systems for plastic bottles and aluminium cans.

- Reuse quotas based on the type of beverage are proposed. For non-alcoholic beverages, it is to be possible to reuse or refill 10 percent of containers from 2030 and 25 percent from 2040.

Many other countries are following the lead of the EU’s standards in their regulations, Spain being a current example. On the Spanish islands, plastic rings around can packs will be banned from the middle of 2023, explains Tobias Gut, a product manager from Packaging Technology in Rosenheim: “There is already a ban on the import of plastic beverage packaging, i.e. film and plastic rings, in the Balearics and Canaries, for instance. Our LitePac Top is already being used for cans there. What’s more, on the first of January 2023 Spain introduced a plastic tax on packaging made of non-recycled plastic used to protect or wrap goods.”

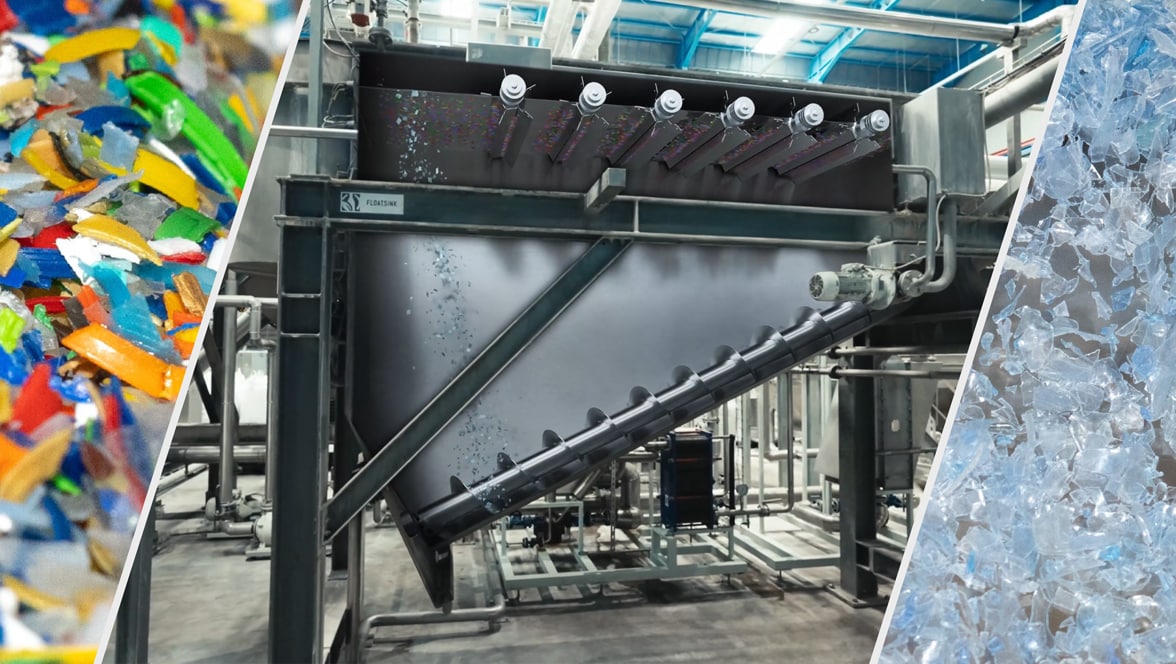

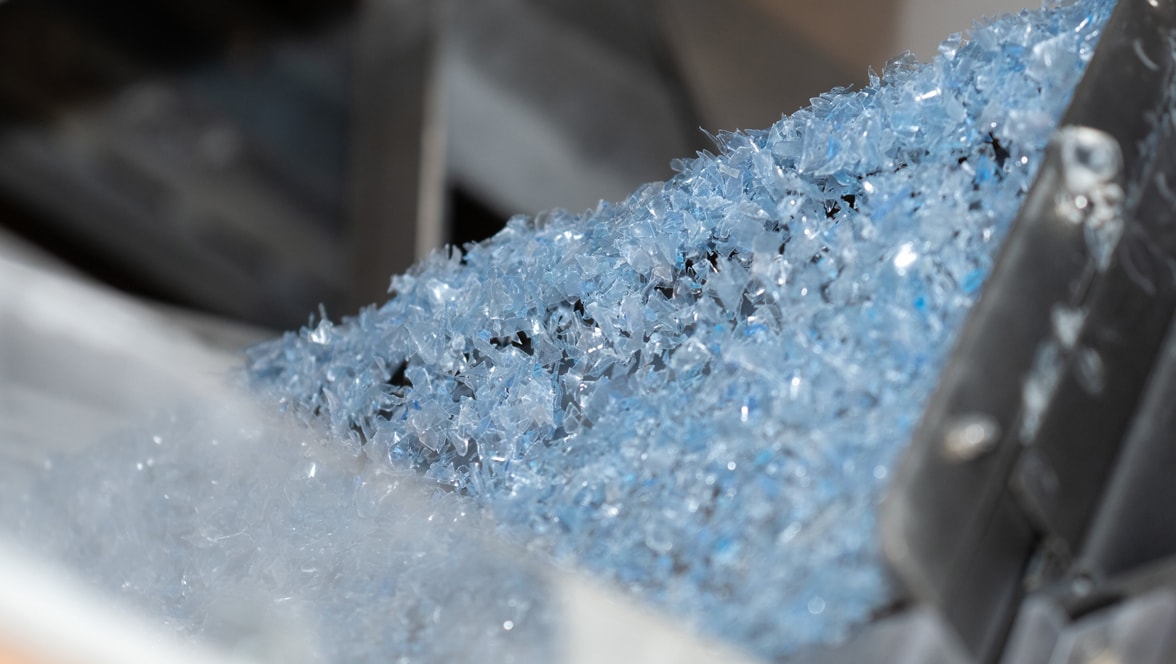

A closer look at PET bottles

A strong trend towards more recycling can be seen with PET beverage bottles. This is being driven not only by legal specifications on recycled material quotas, but also by the companies themselves, explains Michael Auburger, a recycling specialist at Krones: “Businesses are trying to get away from virgin material and make more use of recycling for image reasons also. On top of this is the fact that modern sorting systems are increasingly better at separating the different types of plastic. The technologies have advanced a long way, and rPET can be reused in food packaging, thereby establishing a bottle-to-bottle loop.” Many major manufacturers have since added beverage bottles made of 100 percent rPET to their product ranges.

The market can hardly keep up with the enormous demand for rPET, Manuel Grund has noticed: “Collection has to be organised more efficiently so that the availability of recycled material increases.” What is more, rPET is not just useful for beverage containers – it can also be used for textiles. Many countries have recognised this and are introducing deposit systems and collection quotas. Some are also laying down additional requirements in order to simplify recycling. Korea, for example, is reimbursing water bottlers some of the “resource loop charge” levied on them if the PET bottle does not have a label, as that makes them easier to recycle. At Jeju Province Development Co. in South Korea, for example, water is to be filled into label-free PET bottles in future with the aid of Krones lines.

Statutory requirements for deposit systems

| Germany | Mandatory deposit since 2002 on all single-use PET beverage bottles, with the exception of milk bottles, for which it applies from 2024 |

| Austria | Mandatory deposit from 2025 on all single-use beverage packaging made of plastic and metal |

| EU proposal | Deposit systems from 2029 for plastic bottles and aluminium cans |

| USA and Canada | Some states have deposit systems – known as bottle bills – for beverage containers (aluminium, glass, plastic or cardboard) |

| UK | Deposit on beverage bottles and cans from 2025 with the aim of reducing waste and encouraging recycling |

| Australia | Deposit systems introduced in some states |

Another area that many countries are tackling at the moment is the approval of rPET for food packaging. In Asia especially this is not permitted in many places, partly due to concerns about quality and partly because there is also a market for rPET beyond beverages. Many countries are basing their approval regulations on the certificates of the European Food Safety Authority (EFSA) or those of the U.S. Food and Drug Administration (FDA). That India recently approved rPET for food sends an important signal.

And what about returnables?

The expansion of returnables loops would of course be another way of avoiding waste. That is also why the EU is proposing binding reuse quotas for the new packaging directive. Manuel Grund expects plenty of intensive debate on this: “Many companies have gone over entirely to single-use PET. They would need completely different logistics for returnables, requiring investment in cleaning systems, sorting centres and a bottle pool.” On top of this is the fact that in the event of a shift, such as to PET returnables, this packaging would have to be available on the market or else produced. Returnable PET bottles, for instance, need about twice as much material as the single-use variant and cannot be produced using the same machine.

Returnable systems have been established in only a few regions so far. Alongside Europe and Asia, Grund cites South America in particular: “They have a strong returnable system for large PET bottles of two or more litres. These bottles are very suitable for reuse, which is why such a market has grown up.” A positive example from Europe is the German Berchtesgadener Land dairy, which has been awarded the Reusable Systems Innovation Prize of the German environmental association Deutsche Umwelthilfe (DUH) and the Stiftung Initiative Mehrweg (SIM; Foundation for Reusable Systems) for its new Krones glass line.

It should be exciting, then, to see where the journey will take us in the next few years. Whether the world will get a handle on the flood of plastic and a plastic circular economy will establish itself, Krones will be ready with its technologies – whichever solutions are chosen.